Question: Please answer thoroughly for a thumbs up. X Co. acquired 80% of Y Co. on January 1, Year 3, when Y Co. had common shares

Please answer thoroughly for a thumbs up.

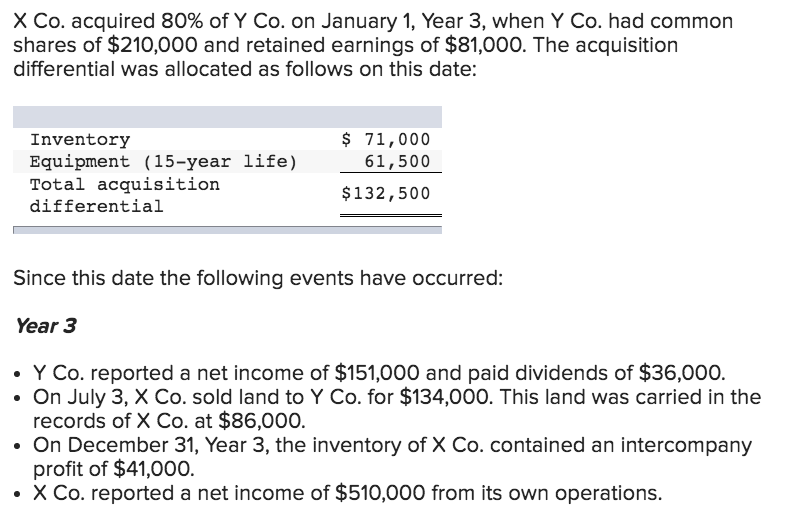

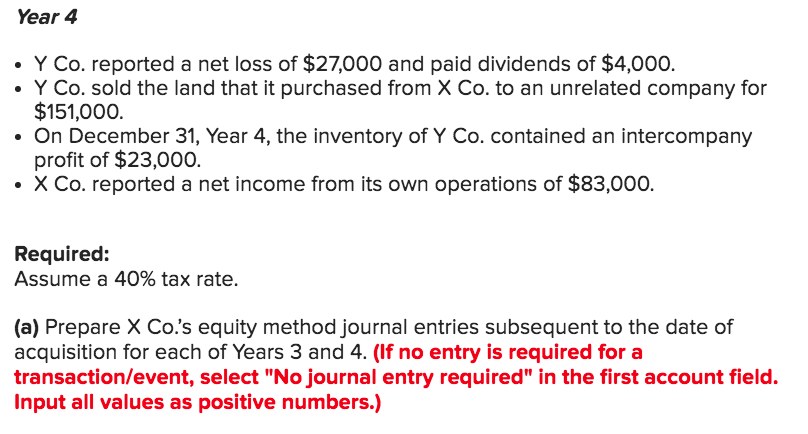

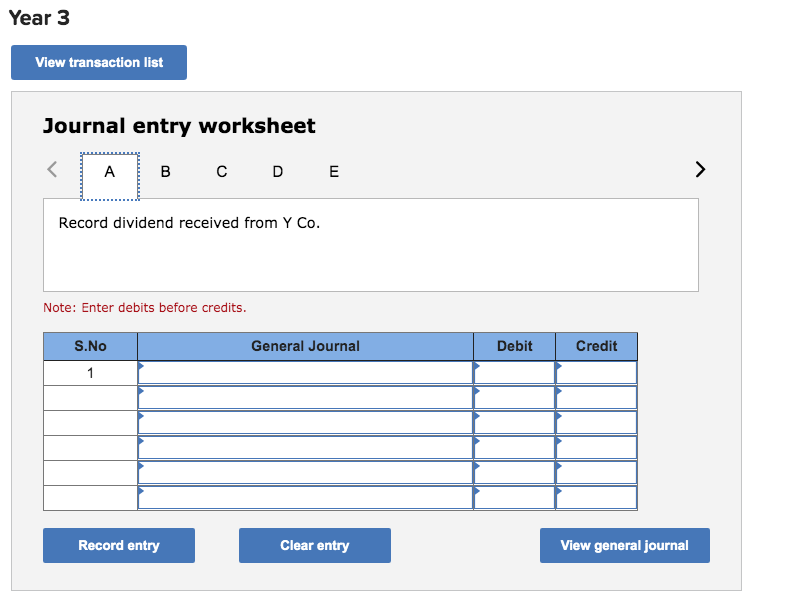

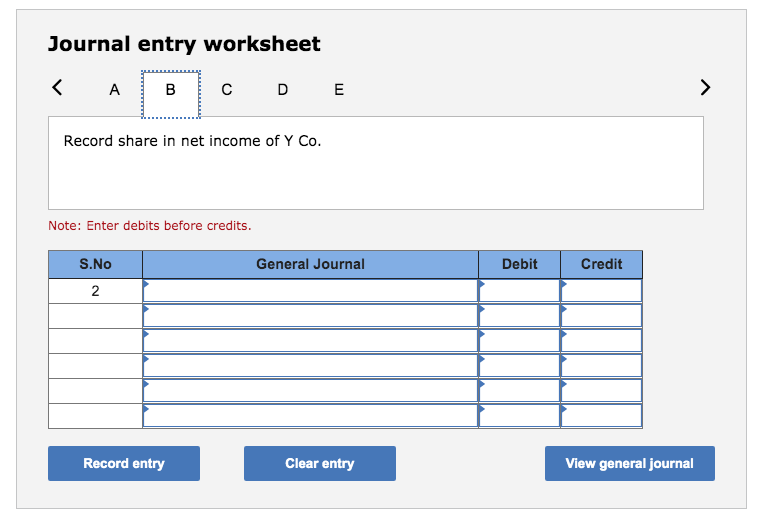

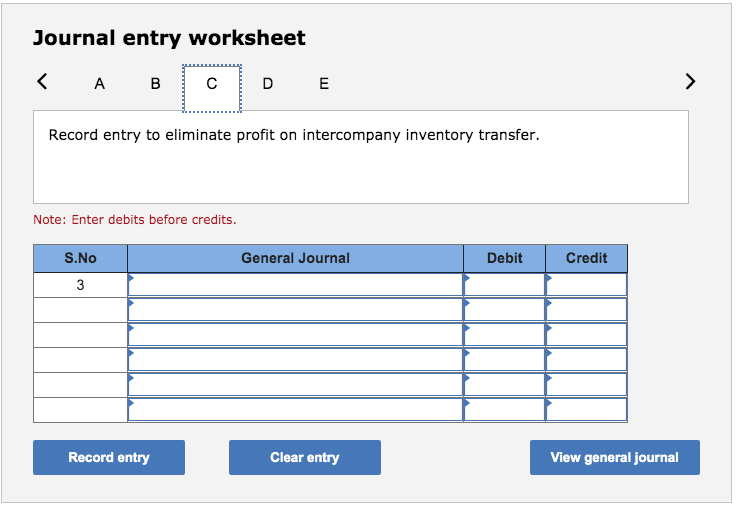

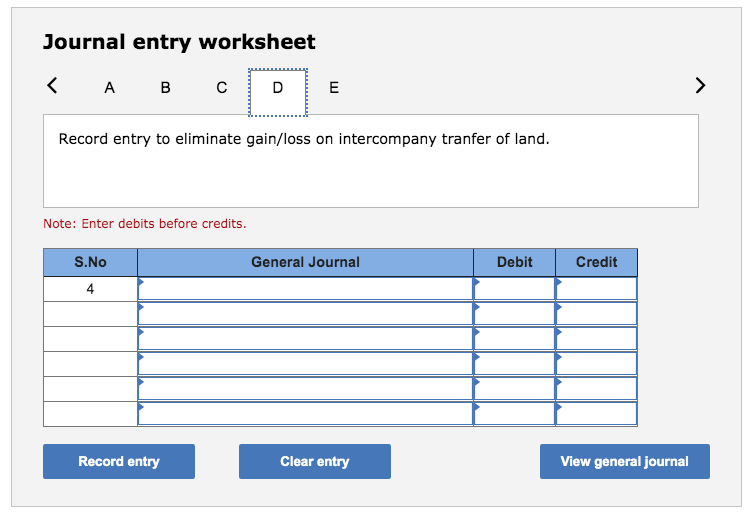

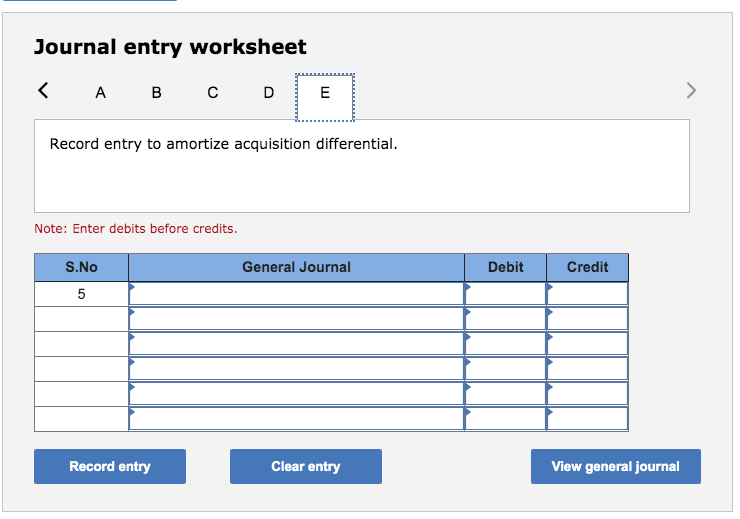

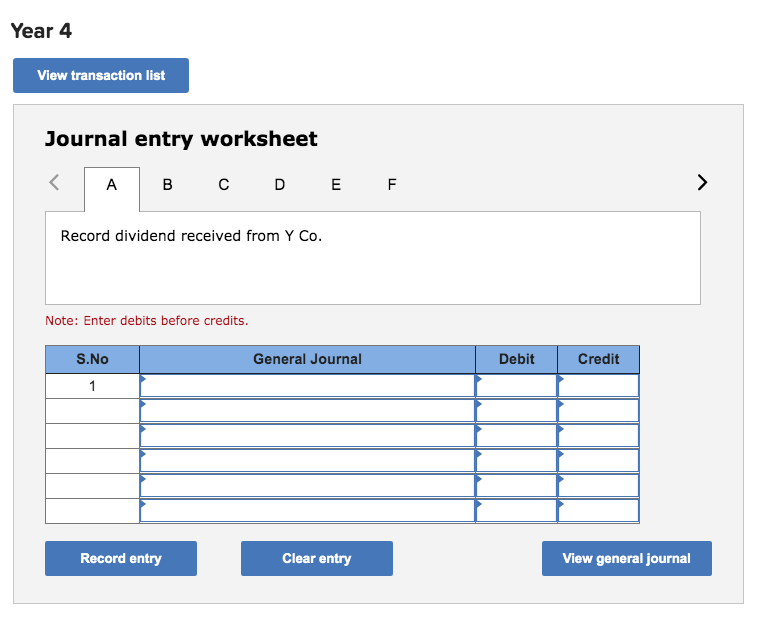

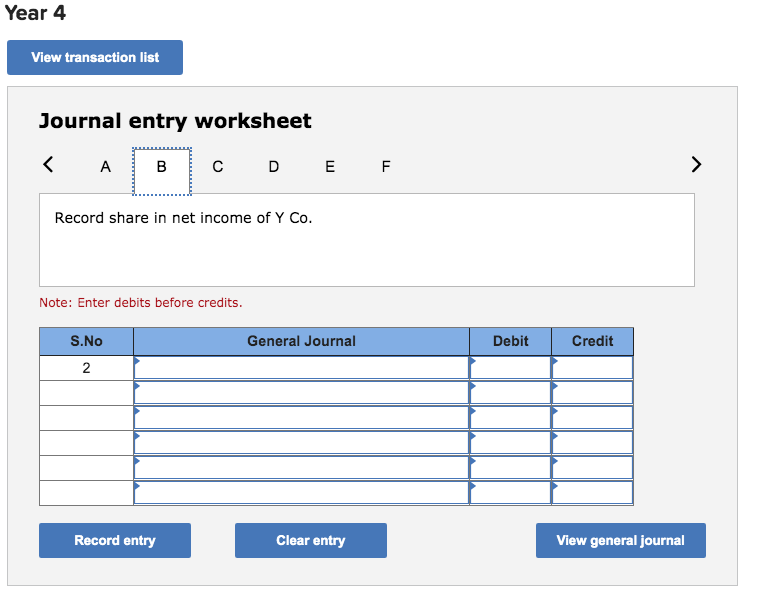

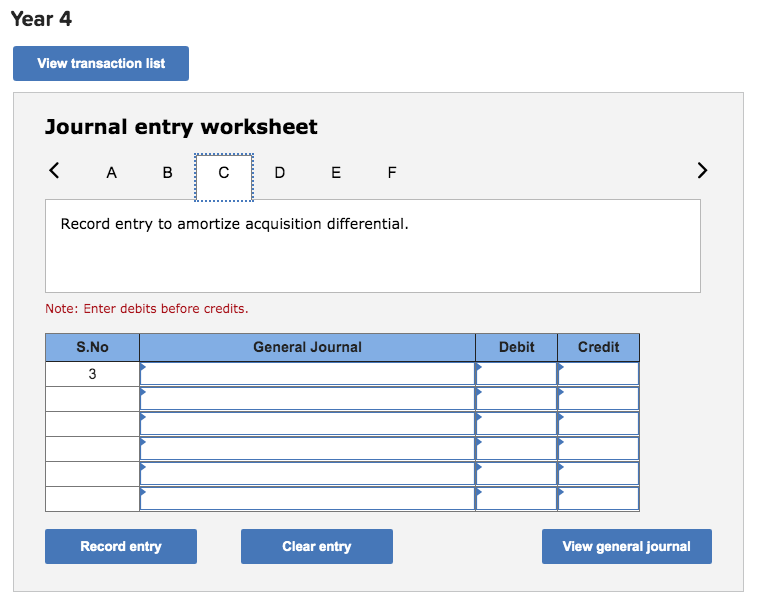

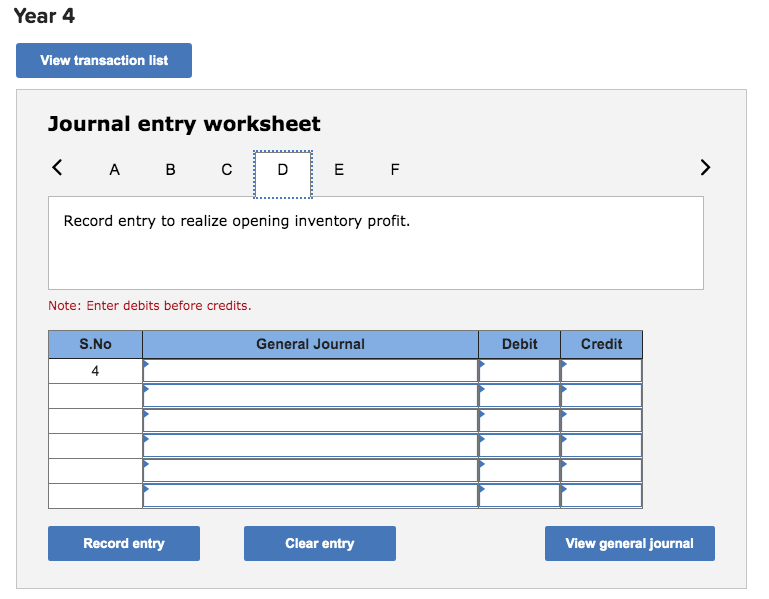

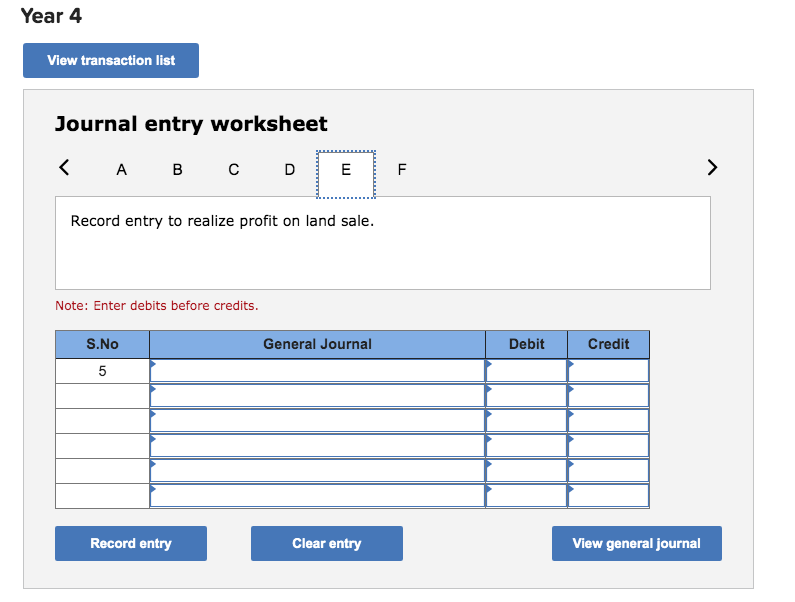

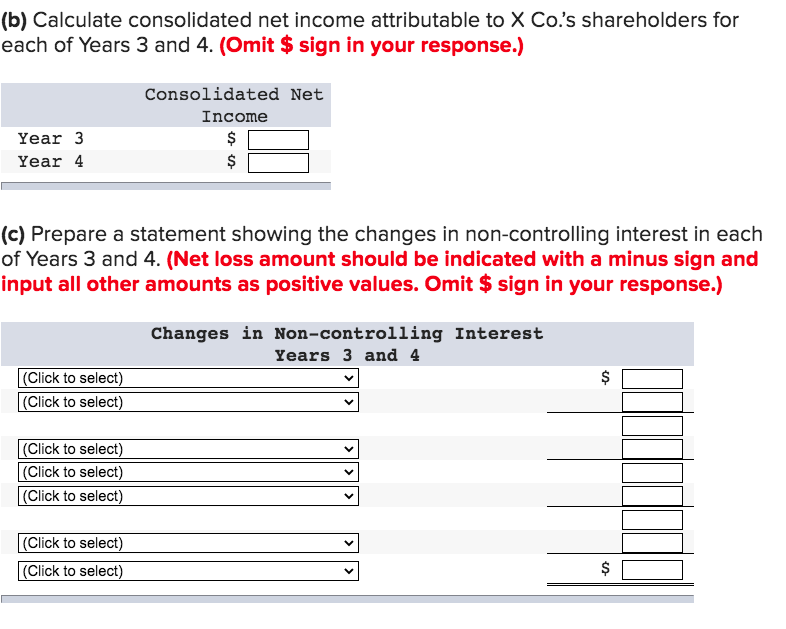

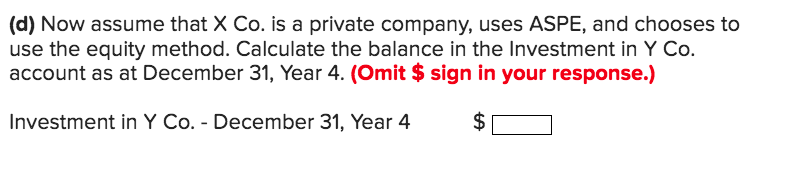

X Co. acquired 80% of Y Co. on January 1, Year 3, when Y Co. had common shares of $210,000 and retained earnings of $81,000. The acquisition differential was allocated as follows on this date: $ 71,000 61,500 Inventory Equipment (15-year life) Total acquisition differential $ 132,500 Since this date the following events have occurred: Year 3 Y Co. reported a net income of $151,000 and paid dividends of $36,000. On July 3, X Co. sold land to Y Co. for $134,000. This land was carried in the records of X Co. at $86,000. On December 31, Year 3, the inventory of X Co. contained an intercompany profit of $41,000. . X Co. reported a net income of $510,000 from its own operations. Year 4 Y Co. reported a net loss of $27,000 and paid dividends of $4,000. Y Co. sold the land that it purchased from X Co. to an unrelated company for $151,000. On December 31, Year 4, the inventory of Y Co. contained an intercompany profit of $23,000. . X Co. reported a net income from its own operations of $83,000. Required: Assume a 40% tax rate. (a) Prepare X Co.'s equity method journal entries subsequent to the date of acquisition for each of Years 3 and 4. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Input all values as positive numbers.) Year 3 View transaction list Journal entry worksheet Record dividend received from Y Co. Note: Enter debits before credits. General Journal Debit Credit S.No 1 Record entry Clear entry View general journal Journal entry worksheet Record share in net income of Y Co. Note: Enter debits before credits. General Journal Debit Credit S.No 2 Record entry Clear entry View general journal Journal entry worksheet Record entry to eliminate gain/loss on intercompany tranfer of land. Note: Enter debits before credits. S.No General Journal Debit Credit 4 Record entry Clear entry View general journal Journal entry worksheet Record entry to amortize acquisition differential. Note: Enter debits before credits. General Journal Debit Credit S.No 5 Record entry Clear entry View general journal Year 4 View transaction list Journal entry worksheet A B D E F > Record dividend received from Y Co. Note: Enter debits before credits. General Journal Debit Credit S.NO 1 Record entry Clear entry View general journal Year 4 4 View transaction list Journal entry worksheet Record share in net income of Y Co. Note: Enter debits before credits. S.No General Journal Debit Credit 2 Record entry Clear entry View general journal Year 4 View transaction list Journal entry worksheet Record entry to amortize acquisition differential. Note: Enter debits before credits. General Journal Debit Credit S.NO 3 Record entry Clear entry View general journal Year 4 View transaction list Journal entry worksheet Record entry to realize opening inventory profit. Note: Enter debits before credits. General Journal Debit Credit S.No 4. Record entry Clear entry View general journal Year 4 View transaction list Journal entry worksheet Record entry to realize profit on land sale. Note: Enter debits before credits. General Journal Debit Credit S.No 5 Record entry Clear entry View general journal (b) Calculate consolidated net income attributable to X Co.'s shareholders for each of Years 3 and 4. (Omit $ sign in your response.) Consolidated Net Income $ $ Year 3 Year 4 (c) Prepare a statement showing the changes in non-controlling interest in each of Years 3 and 4. (Net loss amount should be indicated with a minus sign and input all other amounts as positive values. Omit $ sign in your response.) Changes in Non-controlling Interest Years 3 and 4 $ (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) $ (d) Now assume that X Co. is a private company, uses ASPE, and chooses to use the equity method. Calculate the balance in the Investment in Y Co. account as at December 31, Year 4. (Omit $ sign in your response.) Investment in Y Co.- December 31, Year 4 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts