Question: Please answer thoroughly, start from b and c, and for d the statement is Now assume...management accepts both pics are combined. Thank you Distinctly unimpressed

Please answer thoroughly, start from b and c, and for d the statement is "Now assume...management accepts" both pics are combined. Thank you

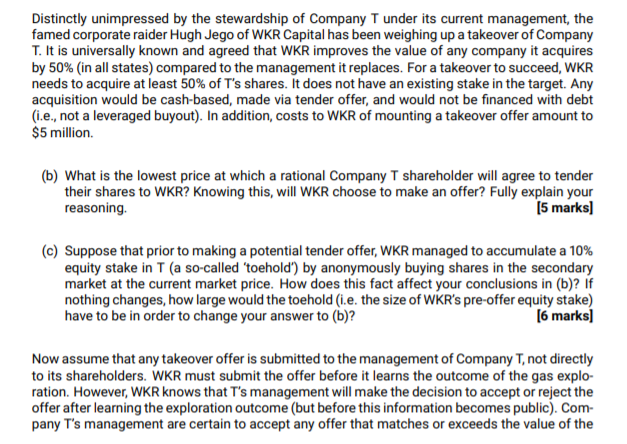

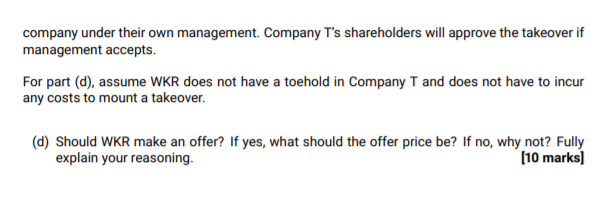

Distinctly unimpressed by the stewardship of Company T under its current management, the famed corporate raider Hugh Jego of WKR Capital has been weighing up a takeover of Company T. It is universally known and agreed that WKR improves the value of any company it acquires by 50% (in all states) compared to the management it replaces. For a takeover to succeed, WKR needs to acquire at least 50% of T's shares. It does not have an existing stake in the target. Any acquisition would be cash-based, made via tender offer, and would not be financed with debt (i.e., not a leveraged buyout). In addition, costs to WKR of mounting a takeover offer amount to $5 million. (b) What is the lowest price at which a rational Company T shareholder will agree to tender their shares to WKR? Knowing this, will WKR choose to make an offer? Fully explain your reasoning. [5 marks] (c) Suppose that prior to making a potential tender offer, WKR managed to accumulate a 10% equity stake in T (a so-called 'toehold') by anonymously buying shares in the secondary market at the current market price. How does this fact affect your conclusions in (b)? If nothing changes, how large would the toehold (i.e. the size of WKR's pre-offer equity stake) have to be in order to change your answer to (b)? [6 marks] Now assume that any takeover offer is submitted to the management of Company T, not directly to its shareholders. WKR must submit the offer before it learns the outcome of the gas explo- ration. However, WKR knows that T's management will make the decision to accept or reject the offer after learning the exploration outcome (but before this information becomes public). Com- pany T's management are certain to accept any offer that matches or exceeds the value of thecompany under their own management. Company T's shareholders will approve the takeover if management accepts. For part (d), assume WKR does not have a toehold in Company T and does not have to incur any costs to mount a takeover. (d) Should WKR make an offer? If yes, what should the offer price be? If no, why not? Fully explain your reasoning. [10 marks]