Question: Please answer those question with round first two decimals Rocket Co. just paid a dividend of $4.00. You anticipate that Rocket Co. will grow at

Please answer those question with round first two decimals

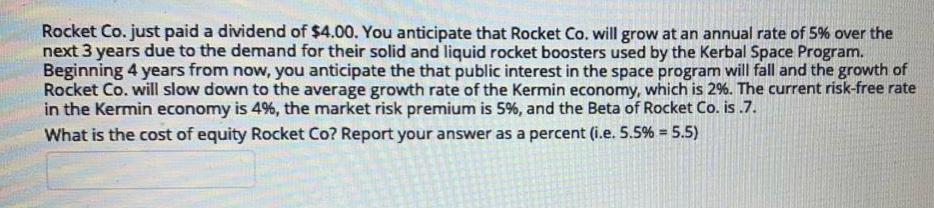

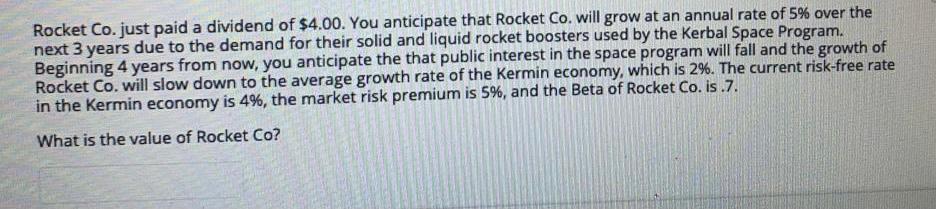

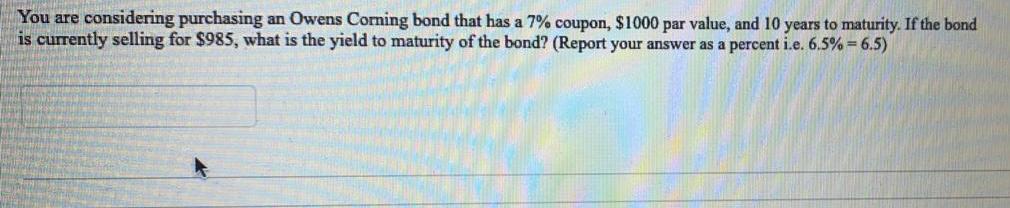

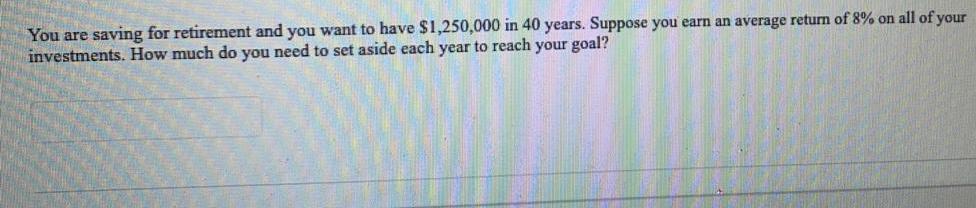

Rocket Co. just paid a dividend of $4.00. You anticipate that Rocket Co. will grow at an annual rate of 5% over the next 3 years due to the demand for their solid and liquid rocket boosters used by the Kerbal Space Program. Beginning 4 years from now, you anticipate the that public interest in the space program will fall and the growth of Rocket Co. will slow down to the average growth rate of the Kermin economy, which is 2%. The current risk-free rate in the Kermin economy is 4%, the market risk premium is 5%, and the Beta of Rocket Co. is.7. What is the cost of equity Rocket Co? Report your answer as a percent (i.e. 5.5% = 5.5) Rocket Co.just paid a dividend of $4.00. You anticipate that Rocket Co. will grow at an annual rate of 5% over the next 3 years due to the demand for their solid and liquid rocket boosters used by the Kerbal Space Program. Beginning 4 years from now, you anticipate the that public interest in the space program will fall and the growth of Rocket Co. will slow down to the average growth rate of the Kermin economy, which is 2%. The current risk-free rate in the Kermin economy is 4%, the market risk premium is 5%, and the Beta of Rocket Co. is .7. What is the value of Rocket Co? You are considering purchasing an Owens Corning bond that has a 7% coupon, $1000 par value, and 10 years to maturity. If the bond is currently selling for $985, what is the yield to maturity of the bond? (Report your answer as a percent i.e. 6.5% = 6.5) You are saving for retirement and you want to have $1,250,000 in 40 years. Suppose you earn an average return of 8% on all of your investments. How much do you need to set aside each year to reach your goal? You want to purchase a $250,000 house and have a 20% down payment. You enter into a 30 year mortgage at a rate of 3%. What is your monthly payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts