Question: Please answer those question with round first two decimals Suppose you have the following possible risky investments (A,B,C,D) and a risk free investment (RF) where

Please answer those question with round first two decimals

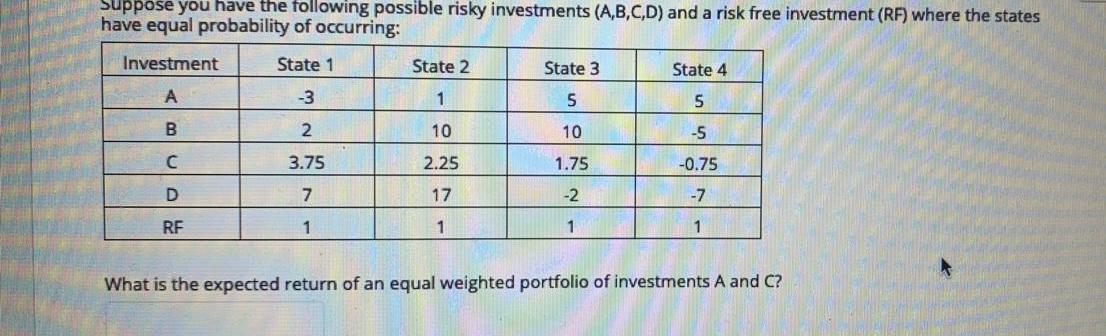

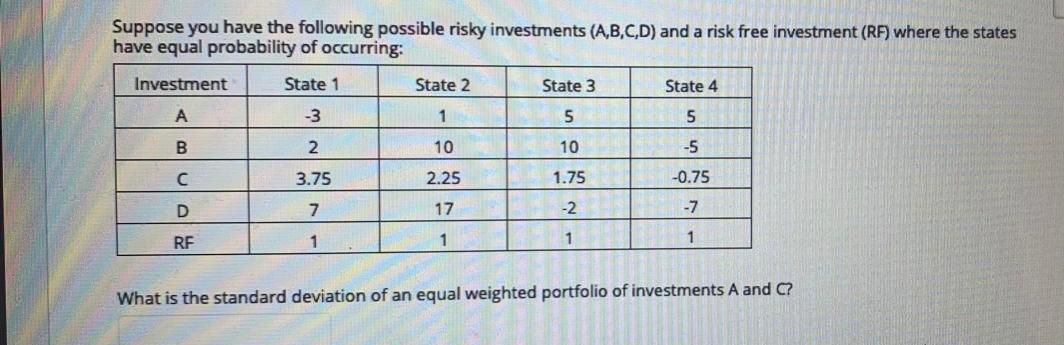

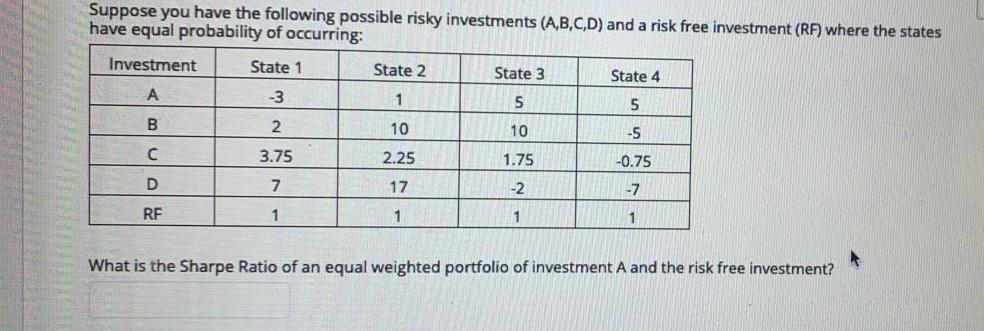

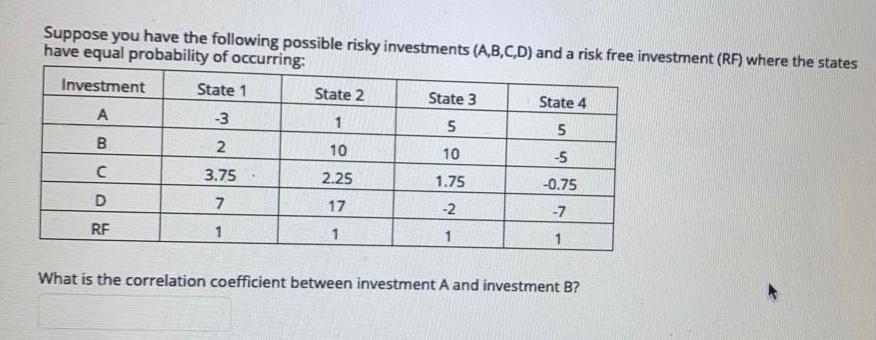

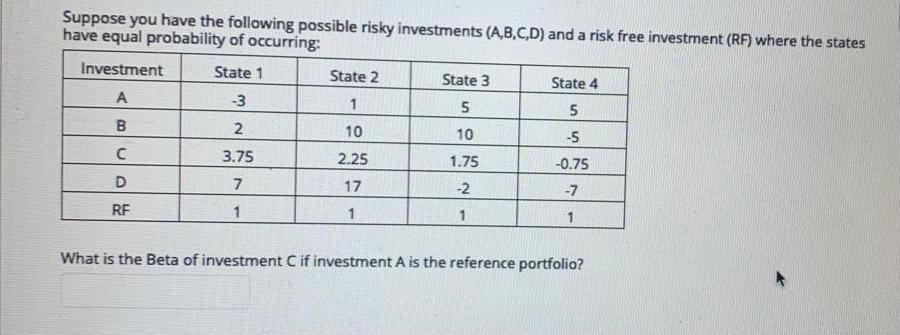

Suppose you have the following possible risky investments (A,B,C,D) and a risk free investment (RF) where the states have equal probability of occurring: Investment State 1 State 2 State 3 State 4 1 5 5 -3 2 10 10 -5 B 3.75 2.25 1.75 -0.75 D 7 17 -2 -7 RF 1 1 1 1 What is the expected return of an equal weighted portfolio of investments A and C? Suppose you have the following possible risky investments (A,B,C,D) and a risk free investment (RF) where the states have equal probability of occurring: Investment State 1 State 2 State 3 State 4 A -3 1 5 5 B 2 10 10 -5 3.75 2.25 1.75 -0.75 D 7 17 -2 -7 RF 1 1 1 1 What is the standard deviation of an equal weighted portfolio of investments A and C? Suppose you have the following possible risky investments (A,B,C,D) and a risk free investment (RF) where the states have equal probability of occurring: Investment State 1 State 2 State 3 State 4 -3 1 5 5 B 2. 10 10 -5 3.75 2.25 1.75 -0.75 D 7 17 -2 - 7 RF 1 1 1 1 What is the Sharpe Ratio of an equal weighted portfolio of investment A and the risk free investment? Suppose you have the following possible risky investments (A,B,C,D) and a risk free investment (RF) where the states have equal probability of occurring: Investment State 1 State 2 State 3 State 4 A -3 1 5 5 B 2 10 10 3.75 2.25 1.75 -5 -0.75 -7 D 7 17 -2 RF 1 1 1 1 What is the correlation coefficient between investment A and investment B? Suppose you have the following possible risky investments (A,B,C,D) and a risk free investment (RF) where the states have equal probability of occurring: Investment State 1 State 2 State 3 State 4 A -3 1 5 5 B 2 10 10 -5 3.75 2.25 1.75 -0.75 7 17 -2 -7 RF 1 1 1 1 What is the Beta of investment C if investment A is the reference portfolio? Suppose you have the following possible risky investments (A,B,C,D) and a risk free investment (RF) where the states have equal probability of occurring: Investment State 1 State 2 State 3 State 4 1 5 5 -3 2 10 10 -5 B 3.75 2.25 1.75 -0.75 D 7 17 -2 -7 RF 1 1 1 1 What is the expected return of an equal weighted portfolio of investments A and C? Suppose you have the following possible risky investments (A,B,C,D) and a risk free investment (RF) where the states have equal probability of occurring: Investment State 1 State 2 State 3 State 4 A -3 1 5 5 B 2 10 10 -5 3.75 2.25 1.75 -0.75 D 7 17 -2 -7 RF 1 1 1 1 What is the standard deviation of an equal weighted portfolio of investments A and C? Suppose you have the following possible risky investments (A,B,C,D) and a risk free investment (RF) where the states have equal probability of occurring: Investment State 1 State 2 State 3 State 4 -3 1 5 5 B 2. 10 10 -5 3.75 2.25 1.75 -0.75 D 7 17 -2 - 7 RF 1 1 1 1 What is the Sharpe Ratio of an equal weighted portfolio of investment A and the risk free investment? Suppose you have the following possible risky investments (A,B,C,D) and a risk free investment (RF) where the states have equal probability of occurring: Investment State 1 State 2 State 3 State 4 A -3 1 5 5 B 2 10 10 3.75 2.25 1.75 -5 -0.75 -7 D 7 17 -2 RF 1 1 1 1 What is the correlation coefficient between investment A and investment B? Suppose you have the following possible risky investments (A,B,C,D) and a risk free investment (RF) where the states have equal probability of occurring: Investment State 1 State 2 State 3 State 4 A -3 1 5 5 B 2 10 10 -5 3.75 2.25 1.75 -0.75 7 17 -2 -7 RF 1 1 1 1 What is the Beta of investment C if investment A is the reference portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts