Question: Please answer those question with round first two decimals The table below reports the historic returns of various asset classes and firm Betas: Equity Corporate

Please answer those question with round first two decimals

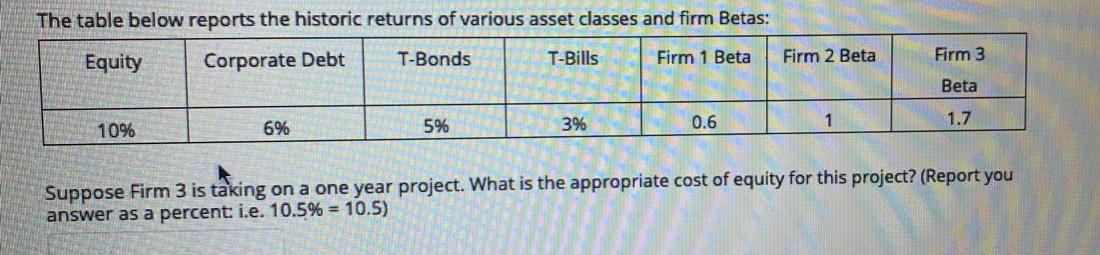

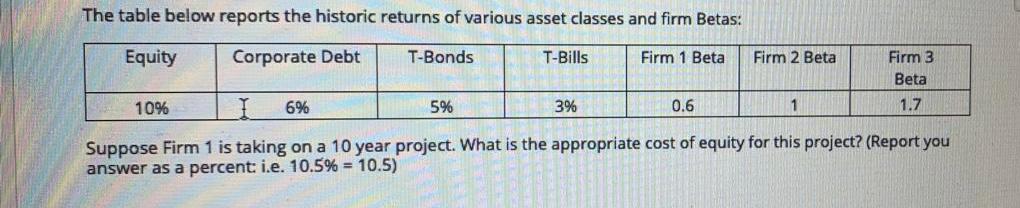

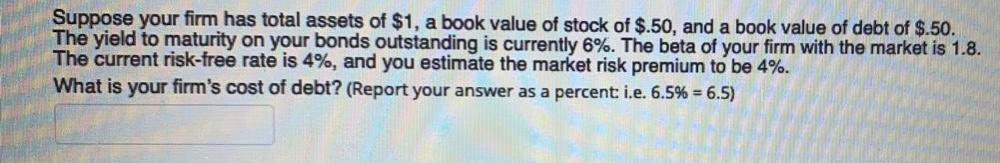

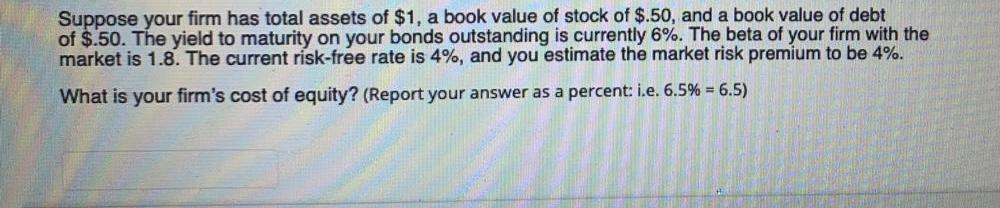

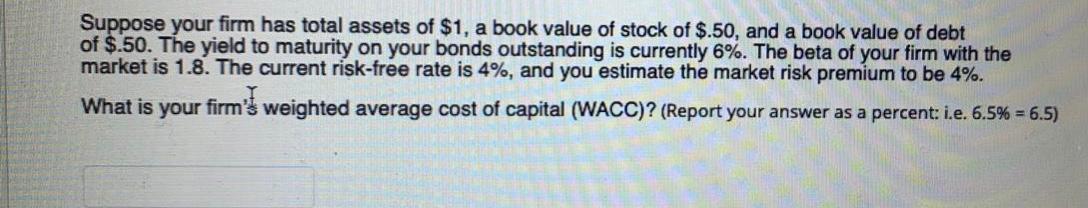

The table below reports the historic returns of various asset classes and firm Betas: Equity Corporate Debt T-Bonds T-Bills Firm 1 Beta Firm 2 Beta Firm 3 Beta 10% 6% 5% 3% 1.7 0.6 Suppose Firm 3 is taking on a one year project. What is the appropriate cost of equity for this project? (Report you answer as a percent: i.e. 10.5% = 10.5) The table below reports the historic returns of various asset classes and firm Betas: Equity Corporate Debt T-Bonds T-Bills Firm 1 Beta Firm 2 Beta Firm 3 Beta 1.7 10% 6% 5% 3% 0.6 1 Suppose Firm 1 is taking on a 10 year project. What is the appropriate cost of equity for this project? (Report you answer as a percent: i.e. 10.5% = 10.5) Suppose your firm has total assets of $1, a book value of stock of $.50, and a book value of debt of $.50. The yield to maturity on your bonds outstanding is currently 6%. The beta of your firm with the market is 1.8. The current risk-free rate is 4%, and you estimate the market risk premium to be 4%. What is your firm's cost of debt? (Report your answer as a percent i.e. 6.5% = 6.5) Suppose your firm has total assets of $1, a book value of stock of $.50, and a book value of debt of $.50. The yield to maturity on your bonds outstanding is currently 6%. The beta of your firm with the market is 1.8. The current risk-free rate is 4%, and you estimate the market risk premium to be 4%. What is your firm's cost of equity? (Report your answer as a percent: i.e. 6.5% = 6.5) Suppose your firm has total assets of $1, a book value of stock of $.50, and a book value of debt of $.50. The yield to maturity on your bonds outstanding is currently 6%. The beta of your firm with the market is 1.8. The current risk-free rate is 4%, and you estimate the market risk premium to be 4%. What is your firm's weighted average cost of capital (WACC)? (Report your answer as a percent: i.e. 6.5% = 6.5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts