Question: Please answer those questions as possible QUESTION 1 QUESTION 2 Shannon Company segments its income statement in its North and South Division. The company's overall

Please answer those questions as possible

QUESTION 1

QUESTION 2

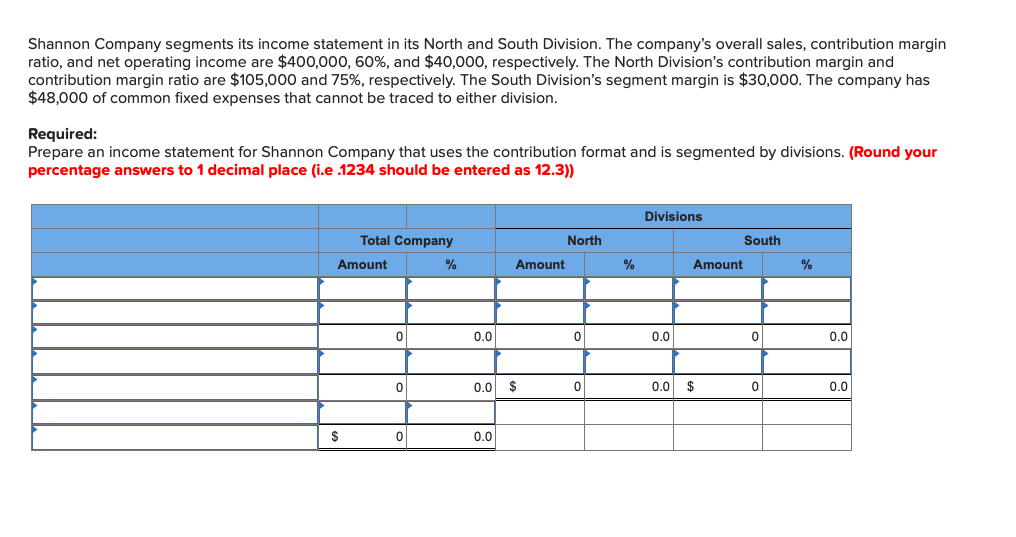

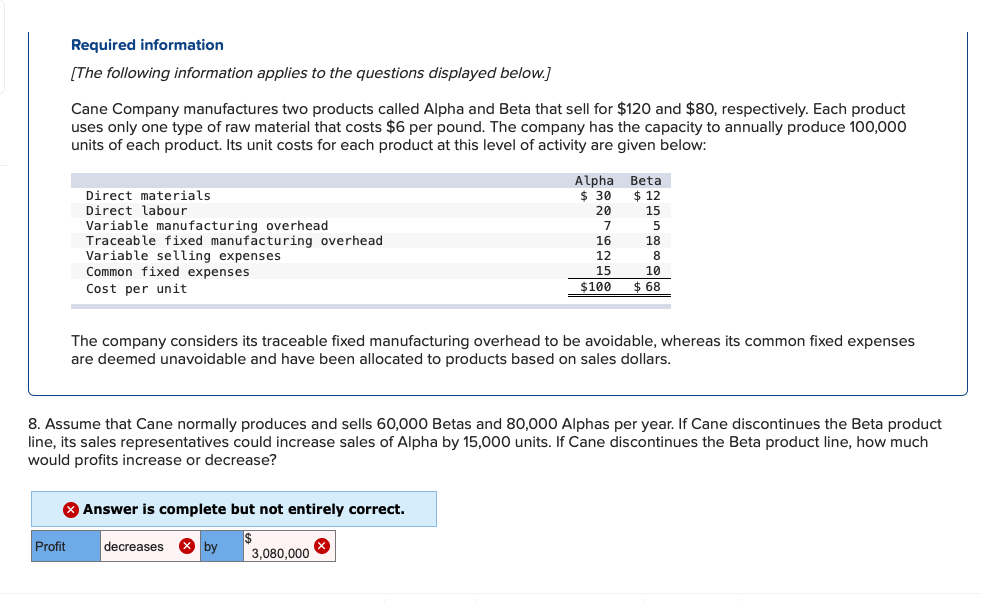

Shannon Company segments its income statement in its North and South Division. The company's overall sales, contribution margin ratio, and net operating income are $400,000,60%, and $40,000, respectively. The North Division's contribution margin and contribution margin ratio are $105,000 and 75%, respectively. The South Division's segment margin is $30,000. The company has $48,000 of common fixed expenses that cannot be traced to either division. Required: Prepare an income statement for Shannon Company that uses the contribution format and is segmented by divisions. (Round your percentage answers to 1 decimal place (i.e .1234 should be entered as 12.3)) Required information [The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $120 and $80, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 100,000 units of each product. Its unit costs for each product at this level of activity are given below: The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars. 8. Assume that Cane normally produces and sells 60,000 Betas and 80,000 Alphas per year. If Cane discontinues the Beta product line, its sales representatives could increase sales of Alpha by 15,000 units. If Cane discontinues the Beta product line, how much would profits increase or decrease? Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts