Question: Please answer those questions only if you know how to do it 4. Cameron Oil Company, a successful efforts company, has capitalized costs on Property

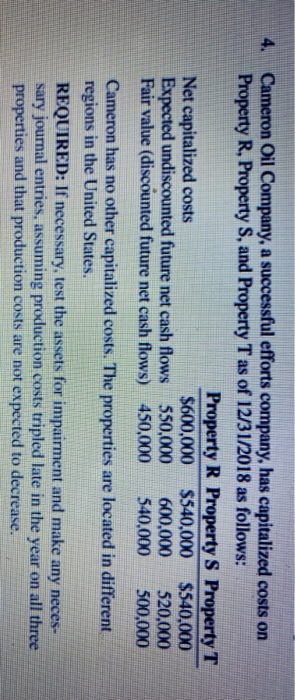

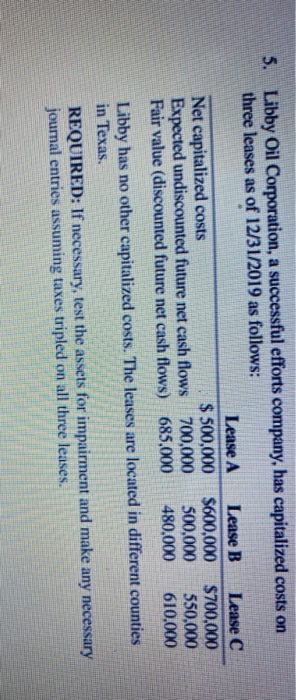

4. Cameron Oil Company, a successful efforts company, has capitalized costs on Property R, Property S, and Property T as of 12/31/2018 as follows: Property R Property S Property T Net capitalized costs $600,000 $540,000 $540,000 Expected undiscounted future net cash flows 550,000 600,000 520,000 Fair value (discounted future net cash flows) 450,000 540,000 500,000 Cameron has no other capitalized costs. The properties are located in different regions in the United States. REQUIRED: If necessary, test the assets for impairment and make any neces- sary journal entries, assuming production costs tripled late in the year on all three properties and that production costs are not expected to decrease. 5. Libby Oil Corporation, a successful efforts company, has capitalized costs on three leases as of 12/31/2019 as follows: Lease A Lease B Lease C Net capitalized costs $ 500,000 $600,000 $700,000 Expected undiscounted future net cash flows 700,000 500,000 550,000 Fair value (discounted future net cash flows) 685,000 480,000 610,000 Libby has no other capitalized costs. The leases are located in different counties in Texas. REQUIRED: If necessary, test the assets for impairment and make any necessary journal entries assuming taxes tripled on all three leases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts