Question: please answer those two questions 1. 2. You are creating a portfolio of two stocks. The first one has a standard deviation of 20% and

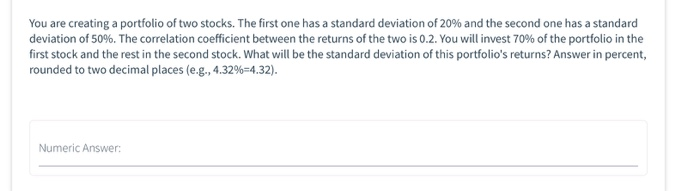

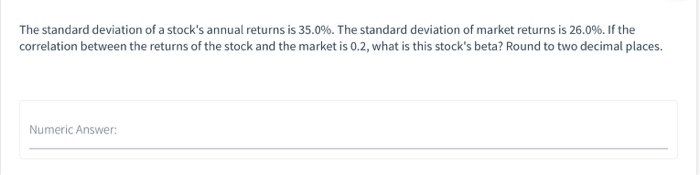

You are creating a portfolio of two stocks. The first one has a standard deviation of 20% and the second one has a standard deviation of 50%. The correlation coefficient between the returns of the two is 0.2. You will invest 70% of the portfolio in the first stock and the rest in the second stock. What will be the standard deviation of this portfolio's returns? Answer in percent, rounded to two decimal places (e.g., 4.32%=4.32). Numeric Answer: The standard deviation of a stock's annual returns is 35.0%. The standard deviation of market returns is 26.0%. If the correlation between the returns of the stock and the market is 0.2, what is this stock's beta? Round to two decimal places. Numeric

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts