Question: Please answer those two questions, if don't bother doing it. I do vote up and down. #1 #2 Required: a. Construct the master budget for

Please answer those two questions, if don't bother doing it. I do vote up and down.

#1

#2

Required:

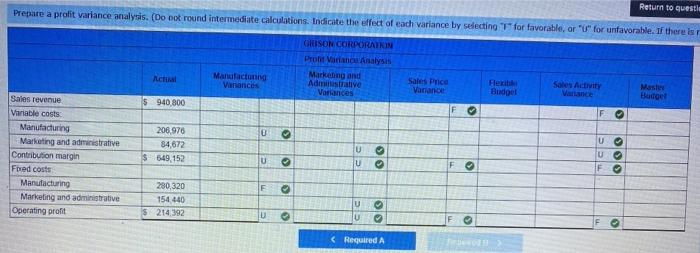

a. Construct the master budget for the period. b. Prepare a profit variance analysis.

A

B.

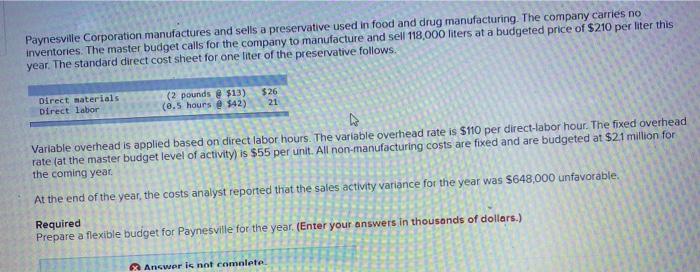

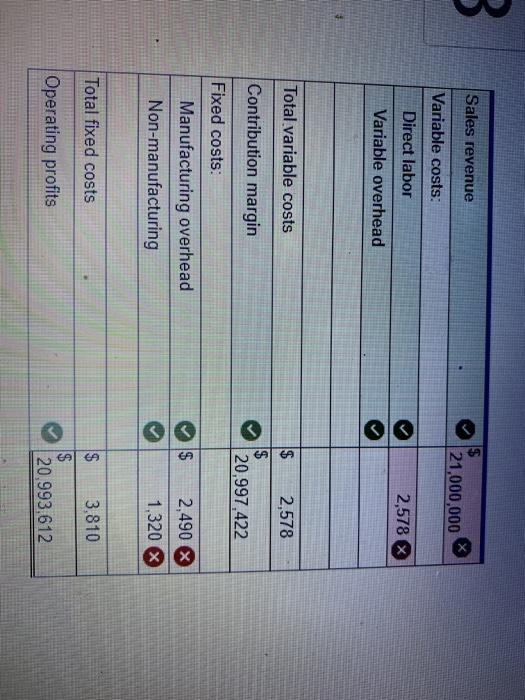

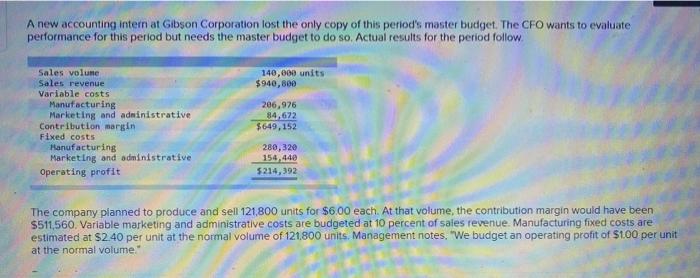

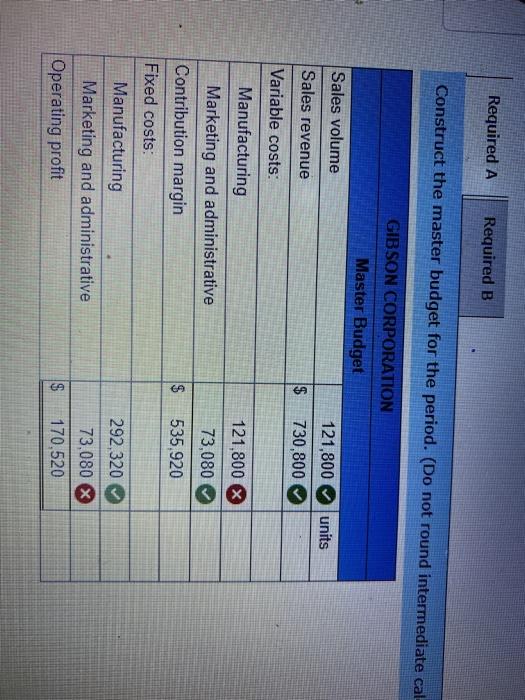

Paynesville Corporation manufactures and sells a preservative used in food and drug manufacturing. The company carries no inventories. The master budget calls for the company to manufacture and sell 118,000 liters at a budgeted price of $210 per liter this year. The standard direct cost sheet for one liter of the preservative follows. (2 pounds @ $13) (0.5 hours $42) $26 21 Direct materials Direct labor Variable overhead is applied based on direct labor hours. The variable overhead rate is $110 per direct-labor hour. The fixed overhead rate (at the master budget level of activity) is $55 per unit. All non-manufacturing costs are fixed and are budgeted at $2,1 million for the coming year At the end of the year, the costs analyst reported that the sales activity variance for the year was $648,000 unfavorable. Required Prepare a flexible budget for Paynesville for the year. (Enter your answers in thousands of dollars.) Answer is not complete 3 Sales revenue $ 21,000,000 Variable costs: Direct labor 2,578 Variable overhead Total variable costs Contribution margin $ 2,578 $ 20,997,422 Fixed costs: Manufacturing overhead Non-manufacturing $ 2,490 X 1,320 X Total fixed costs $ $ 3,810 $ 20,993,612 Operating profits A new accounting intern at Gibson Corporation lost the only copy of this period's master budget. The CFO wants to evaluate performance for this period but needs the master budget to do so. Actual results for the period follow 140,000 units $940,800 Sales volume Sales revenue Variable costs Manufacturing Marketing and administrative Contribution margin Fixed costs Manufacturing Marketing and administrative Operating profit 206,976 84,672 $649, 152 280,320 154,440 5214,392 The company planned to produce and sell 121,800 units for $6.00 each. At that volume, the contribution margin would have been $511,560. Variable marketing and administrative costs are budgeted at 10 percent of sales revenue Manufacturing fixed costs are estimated at $2.40 per unit at the normal volume of 121,800 units. Management notes. We budget an operating profit of $100 per unit at the normal volume" Return to questa Prepare a profit variance analysis. (Do not round intermediate calculations. Indicate the effect of each variance by selecting for favorable, or "" for unfavorable. If there is GUSON CORPORATION Prot Variance Analysis Marketing and Administrative Varances Actual Manufacturing Vanances Sales Price Variance Flexible Budget Sales Act Maste Budget $940.800 F F 0 Sales revenue Variable costs Manufacturing Marketing and administrative Contribution margin Fored costs Manufacturing Marketing and administrative Operating profit 206.976 84,672 $ 549,152 U Oo U U FO U U F F 280,320 154 440 $ 214,392 U U s U IF O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts