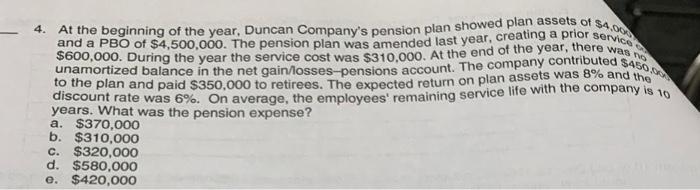

Question: please answer three multiple choice questions 4. At the beginning of the year, Duncan Company's pension plan showed plan assets of $4,00. and a PBO

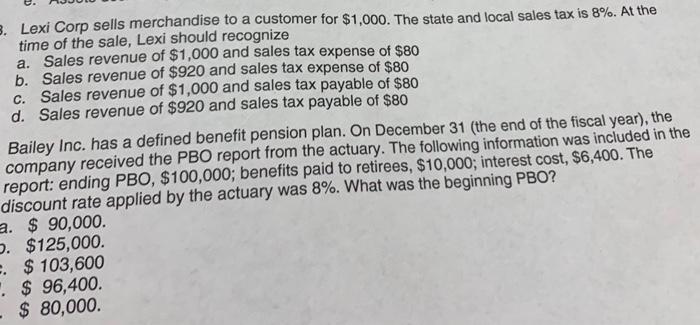

4. At the beginning of the year, Duncan Company's pension plan showed plan assets of \$4,00. and a PBO of $4,500,000. The pension plan was amended last year, creating a prior service, $600,000. During the year the service cost was $310,000. At the end of the year, there was no unamortized balance in the net gain/losses-pensions account. The company contributed $450, 0 . discount rate was 6%. On average, the er a. $370,000 b. $310,000 c. $320,000 d. $580,000 0. $420,000 Lexi Corp sells merchandise to a customer for $1,000. The state and local sales tax is 8%. At the time of the sale, Lexi should recognize a. Sales revenue of $1,000 and sales tax expense of $80 b. Sales revenue of $920 and sales tax expense of $80 c. Sales revenue of $1,000 and sales tax payable of $80 d. Sales revenue of $920 and sales tax payable of $80 Bailey Inc. has a defined benefit pension plan. On December 31 (the end of the fiscal year), the company received the PBO report from the actuary. The following information was included in the report: ending PBO,$100,000; benefits paid to retirees, $10,000; interest cost, $6,400. The discount rate applied by the actuary was 8%. What was the beginning PBO? $90,000. $125,000 $103,600 $96,400 $80,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts