Question: please answer to question; E12-9, --- 1, 2, thank you 1. What is the amount UI CIC 2. How would your answer change if Cressman

please answer to question; E12-9, --- 1, 2, thank you

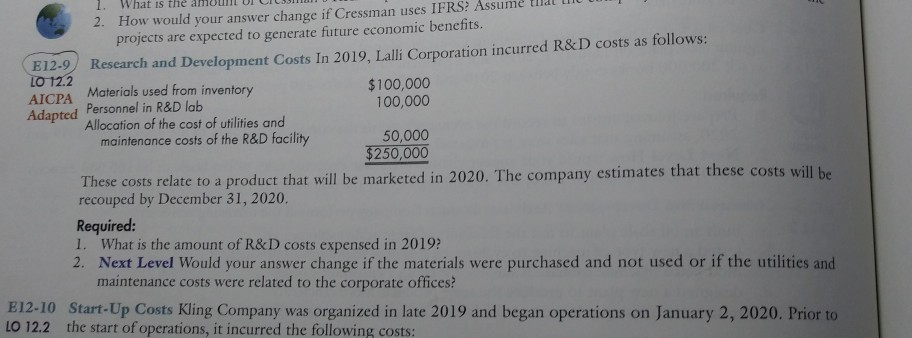

1. What is the amount UI CIC 2. How would your answer change if Cressman uses IFRS? Assume that the projects are expected to generate future economic benefits. E12.9 Research and Development Costs In 2019. Lalli Corporation incurred R&D costs as follows: LO 12.2 $100,000 AICPA Materials used from inventory Adapted Personnel in R&D lab 100,000 Allocation of the cost of utilities and maintenance costs of the R&D facility 50,000 $250,000 These costs relate to a product that will be marketed in 2020. The company estimates that these costs will be recouped by December 31, 2020. Required: 1. What is the amount of R&D costs expensed in 2019? 2. Next Level Would your answer change if the materials were purchased and not used or if the utilities and maintenance costs were related to the corporate offices? E12-10 Start-Up Costs Kling Company was organized in late 2019 and began operations on January 2, 2020. Prior to LO 12.2 the start of operations, it incurred the following costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts