Question: Please answer to question, P13-5. Thank you, J U U UUDICILLICCIPLS 115 P13-5 LO 13.2 both methods. Discount Amortization on Bond Investment and Partial Sale

Please answer to question, P13-5. Thank you,

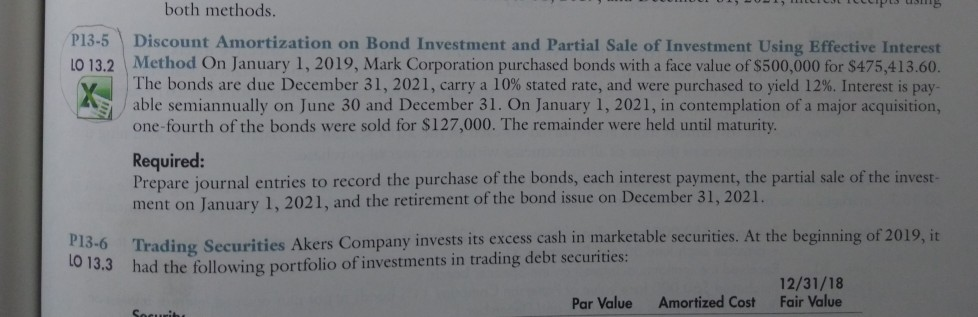

J U U UUDICILLICCIPLS 115 P13-5 LO 13.2 both methods. Discount Amortization on Bond Investment and Partial Sale of Investment Using Effective Interest Method On January 1, 2019, Mark Corporation purchased bonds with a face value of $500,000 for $475,413.60. The bonds are due December 31, 2021, carry a 10% stated rate, and were purchased to yield 12%. Interest is pay able semiannually on June 30 and December 31. On January 1, 2021, in contemplation of a major acquisition, one-fourth of the bonds were sold for $127,000. The remainder were held until maturity Required: Prepare journal entries to record the purchase of the bonds, each interest payment, the partial sale of the invest ment on January 1, 2021, and the retirement of the bond issue on December 31, 2021. 118-6 13.3 Trading Securities Akers Company invests its excess cash in marketable securities. At the beginning of 2019, it had the following portfolio of investments in trading debt securities: 12/31/18 Par Value Amortized Cost Fair Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts