Question: Please answer to red boxes The adjusted trial balance for Carla Vista Company is presented below. CARLA VISTA COMPANY Adjusted Trial Balance August 31, 2021

Please answer to red boxes

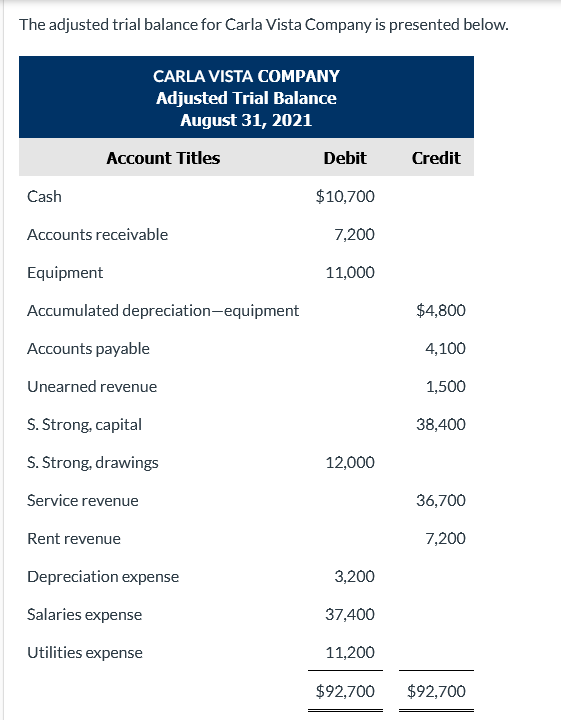

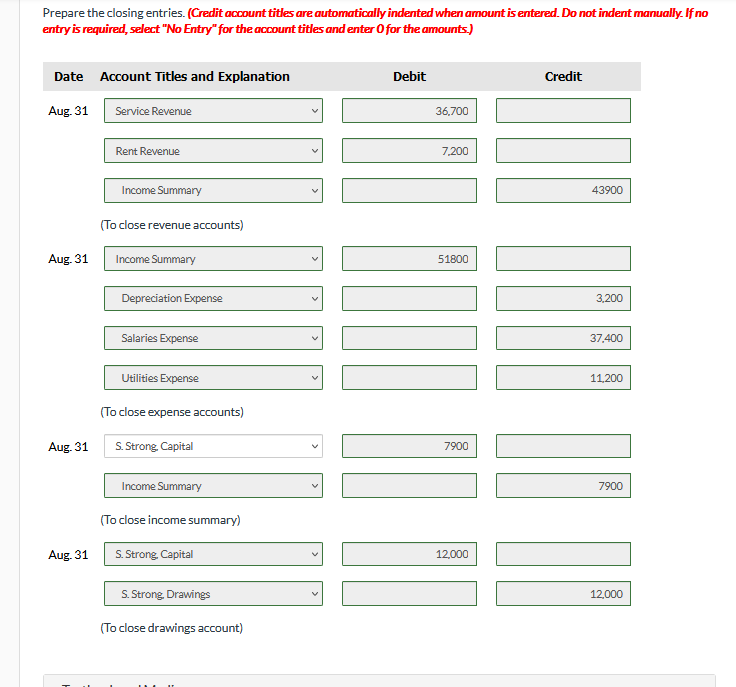

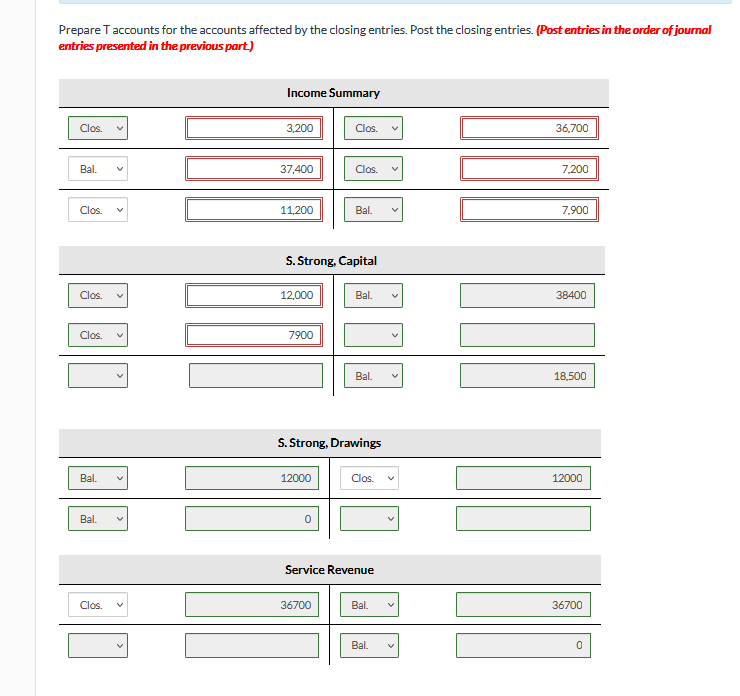

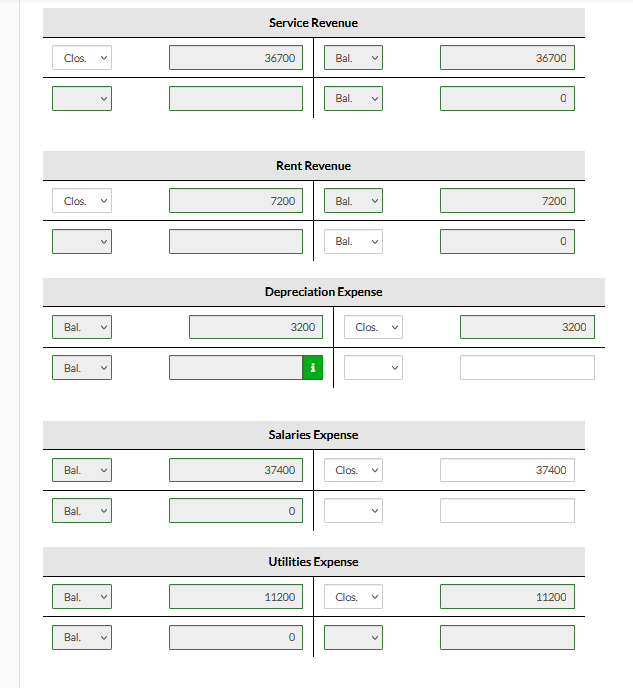

The adjusted trial balance for Carla Vista Company is presented below. CARLA VISTA COMPANY Adjusted Trial Balance August 31, 2021 Account Titles Debit Credit Cash $10,700 Accounts receivable 7,200 Equipment 11,000 Accumulated depreciation-equipment $4,800 Accounts payable 4,100 Unearned revenue 1,500 S. Strong, capital 38,400 12,000 S. Strong, drawings Service revenue 36,700 Rent revenue 7,200 Depreciation expense 3,200 Salaries expense 37,400 Utilities expense 11,200 $92,700 $92,700 Prepare the closing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Aug. 31 Service Revenue 36,700 Rent Revenue 7,200 Income Summary 43900 (To close revenue accounts) Aug 31 Income Summary 51800 Depreciation Expense 3.200 Salaries Expense 37.400 Utilities Expense 11,200 (To close expense accounts) Aug 31 S. Strong. Capital 7900 Income Summary 7900 IT (To close income summary) Aug. 31 S. Strong. Capital 12,000 S. Strong Drawings 12,000 (To close drawings account) Prepare T accounts for the accounts affected by the closing entries. Post the closing entries. (Post entries in the order of journal entries presented in the previous part) Income Summary Clos. 3,200 Clos. 36.700 Bal. 37.400 Clos. 7,200 Clos. 11,200 Bal. 7.900 S. Strong, Capital Clos. 12,000 Bal. 38400 Clos. 7900 Bal. 18.500 S. Strong, Drawings Bal. 12000 Clos. 12000 Bal. 0 Service Revenue Clos. V 36700 Bal. 36700 Bal. 0 Service Revenue Clos. 36700 Bal. 36700 Bal. 0 Rent Revenue Clos. V 7200 Bal. 7200 Bal. 0 Depreciation Expense Bal. 3200 Clos 3200 Bal. Salaries Expense Bal. 37400 Clos. V 37400 Bal. 0 Utilities Expense Bal. 11200 Clos. 11200 Bal. 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts