Question: please answer together QUESTION 23 Use the following information for the next few questions Information concerning the capital structure of Piper Corporation is as follows:

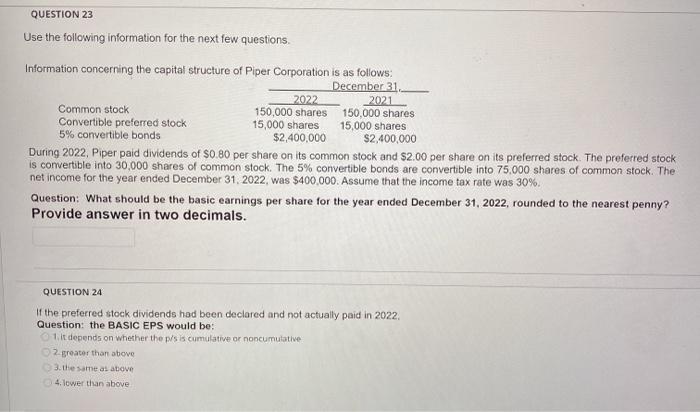

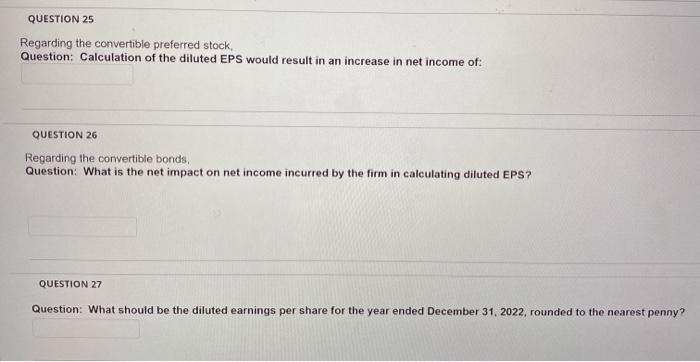

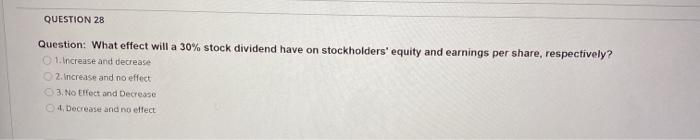

QUESTION 23 Use the following information for the next few questions Information concerning the capital structure of Piper Corporation is as follows: December 31. 2022 2021 Common stock 150,000 shares 150,000 shares Convertible preferred stock 15,000 shares 15,000 shares 5% convertible bonds $2,400,000 $2,400,000 During 2022, Piper paid dividends of $0.80 per share on its common stock and $2.00 per share on its preferred stock. The preferred stock is convertible into 30,000 shares of common stock. The 5% convertible bonds are convertible into 75.000 shares of common stock. The net income for the year ended December 31, 2022, was $400,000. Assume that the income tax rate was 30% Question: What should be the basic earnings per share for the year ended December 31, 2022, rounded to the nearest penny? Provide answer in two decimals. QUESTION 24 If the preferred stock dividends had been declared and not actually paid in 2022 Question: the BASIC EPS would be: 1. It depends on whether the p/sis cumulative or no cumulative 2 greater than above 3. the same as above 4. lower than above QUESTION 25 Regarding the convertible preferred stock, Question: Calculation of the diluted EPS would result in an increase in net income of: QUESTION 26 Regarding the convertible bonds, Question: What is the net impact on net income incurred by the firm in calculating diluted EPS? QUESTION 27 Question: What should be the diluted earnings per share for the year ended December 31, 2022, rounded to the nearest penny? QUESTION 28 Question: What effect will a 30% stock dividend have on stockholders' equity and earnings per share, respectively? 1. Increase and decrease 2. Increase and no effect 3. No Elfect and Decrease 4. Decrease and no effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts