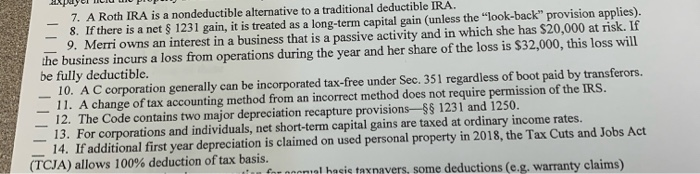

Question: please answer true / false 7. A Roth IRA is a nondeductible alternative to a traditional deductible IRA. 8. If there is a net $

7. A Roth IRA is a nondeductible alternative to a traditional deductible IRA. 8. If there is a net $ 1231 gain, it is treated as a long-term capital gain (unless the "look-back" provision applies). 9. Merri owns an interest in a business that is a passive activity and in which she has $20.000 at risk. If the business incurs a loss from operations during the year and her share of the loss is $32,000, this loss will be fully deductible. _10. A C corporation generally can be incorporated tax-free under Sec. 351 regardless of boot paid by transferors. 11. A change of tax accounting method from an incorrect method does not require permission of the IRS. 12. The Code contains two major depreciation recapture provisions-$8 1231 and 1250. 13. For corporations and individuals, net short-term capital gains are taxed at ordinary income rates. - 14. If additional first year depreciation is claimed on used personal property in 2018, the Tax Cuts and Jobs Act (TCJA) allows 100% deduction of tax basis. - hacie taxpayers some deductions en waranty claims

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts