Question: Please Answer True or False and Multiple Choices. BM 410 Roll No: Financial Institutions and Markets Part (B) Answer No. 6 and No. 7 in

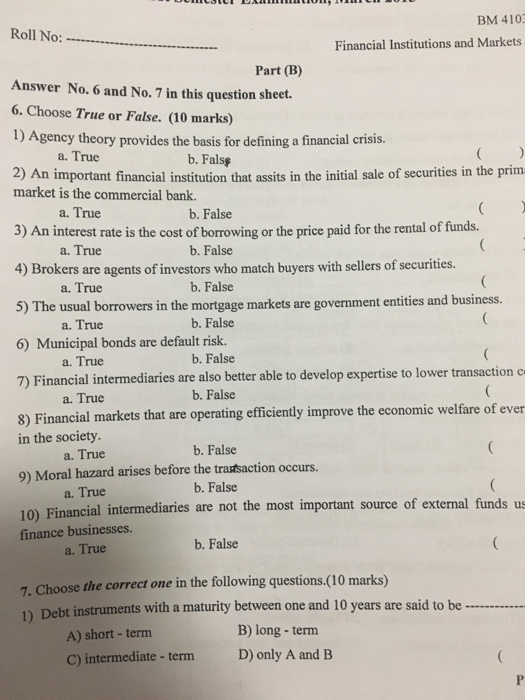

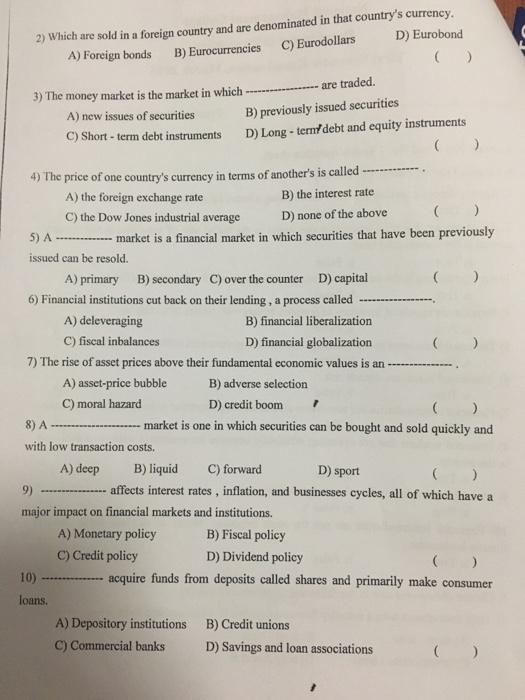

BM 410 Roll No: Financial Institutions and Markets Part (B) Answer No. 6 and No. 7 in this question sheet. 6. Choose True or False. (10 marks) 1) Agency theory provides the basis for defining a financial crisis. 2) An important financial institution that assits in the initial sale of securities in the prim a. True b. Falss market is the commercial bank. 3) An interest rate is the cost of borrowing or the price paid for the rental of funds. 4) Brokers are agents of investors who match buyers with sellers of securities. 5) The usual borrowers in the mortgage markets 6) Municipal bonds are default risk. 7) Financial intermediaries are also better able to develop expertise to lower transaction c 8) Financial markets that are operating efficiently improve the economic welfare of ever a. True a. True a. True a. True b. False b. False b. False b. False b. False b. False a. True a. True in the society 9) Moral hazard arises before the tratsaction occurs. 10) Financial intermediaries are not the most important source of external funds us b. False a. True b. False a. True finance businesses. True b. False a. 7. Choose the correct one in the following questions.(10 marks) 1) Debt instruments with a maturity between one and 10 years are said to be -. A) short - term C) intermediate - term B) long - term D) only A and B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts