Question: Please answer urgently. Question 5 a) A German company will receive 525,000 from a UK customer on 25 April 20x9. It is now 10 September

Please answer urgently.

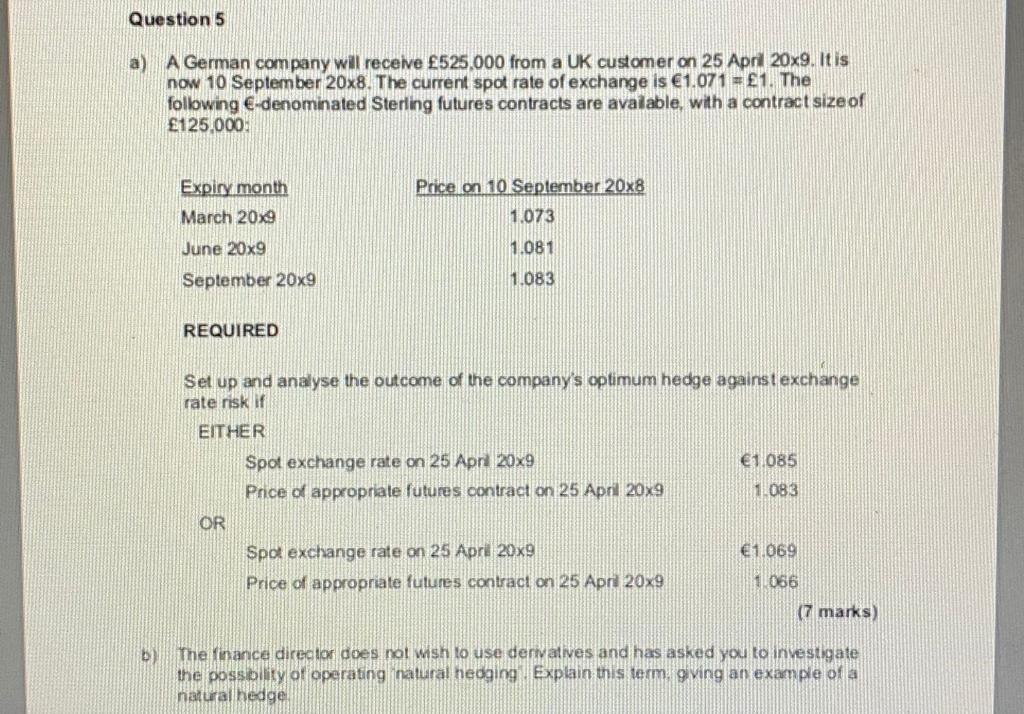

Question 5 a) A German company will receive 525,000 from a UK customer on 25 April 20x9. It is now 10 September 20x8. The current spot rate of exchange is 1.071 = 1. The following -denominated Sterling futures contracts are available, with a contract size of 125,000 Price on 10 September 20x8 1.073 Expiry month March 20x9 June 20x9 September 20x9 1.081 1.083 REQUIRED Set up and analyse the outcome of the company's optimum hedge against exchange rate risk of EITHER Spot exchange rate on 25 April 20x9 1.085 Price of appropriate futures contract on 25 April 20x9 1.083 OR Spot exchange rate on 25 Apri 20x9 1.069 Price of appropriate futures contract on 25 April 20x9 1066 (7 marks) b The finance director does not wish use derivatives and has asked you to investigate the possibility of operating natural nedging Explain this term giving an example of a natural hedge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts