Question: Please answer Using chapter 3 solve the following: In January 1, 2017 Jamal Company has acquired 74% of happy Company for $2,220,000 on the date

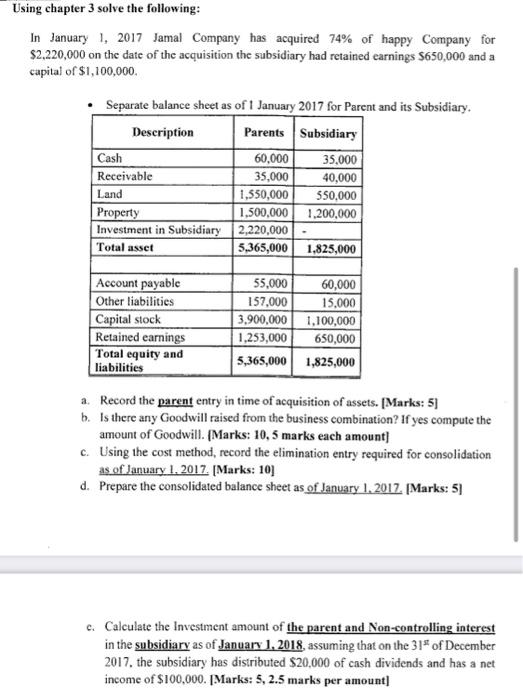

Using chapter 3 solve the following: In January 1, 2017 Jamal Company has acquired 74\% of happy Company for $2,220,000 on the date of the acquisition the subsidiary had retained earnings $650,000 and a capital of $1,100,000. - Separate balance sheet as of 1 January 2017 for Parent and its Subsidiary. a. Record the parent entry in time of acquisition of assets. [Marks: 5] b. Is there any Goodwill raised from the business combination? If yes compute the amount of Goodwill. [Marks: 10,5 marks each amount] c. Using the cost method, record the elimination entry required for consolidation as of January 1. 2017. [Marks: 10] d. Prepare the consolidated balance sheet as of January 1. 2017. [Marks: 5] c. Calculate the lnvestment amount of the parent and Non-controlling interest in the subsidiary as of January 1.2018, assuming that on the 31 of December 2017, the subsidiary has distributed $20,000 of cash dividends and has a net income of $100,000. [Marks: 5,2.5 marks per amount]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts