Question: Please answer using excel and provide/explain formulas used Westmed is building a new facility in Arizona for manufacturing medical equipment. The new building is expected

Please answer using excel and provide/explain formulas used

Please answer using excel and provide/explain formulas used

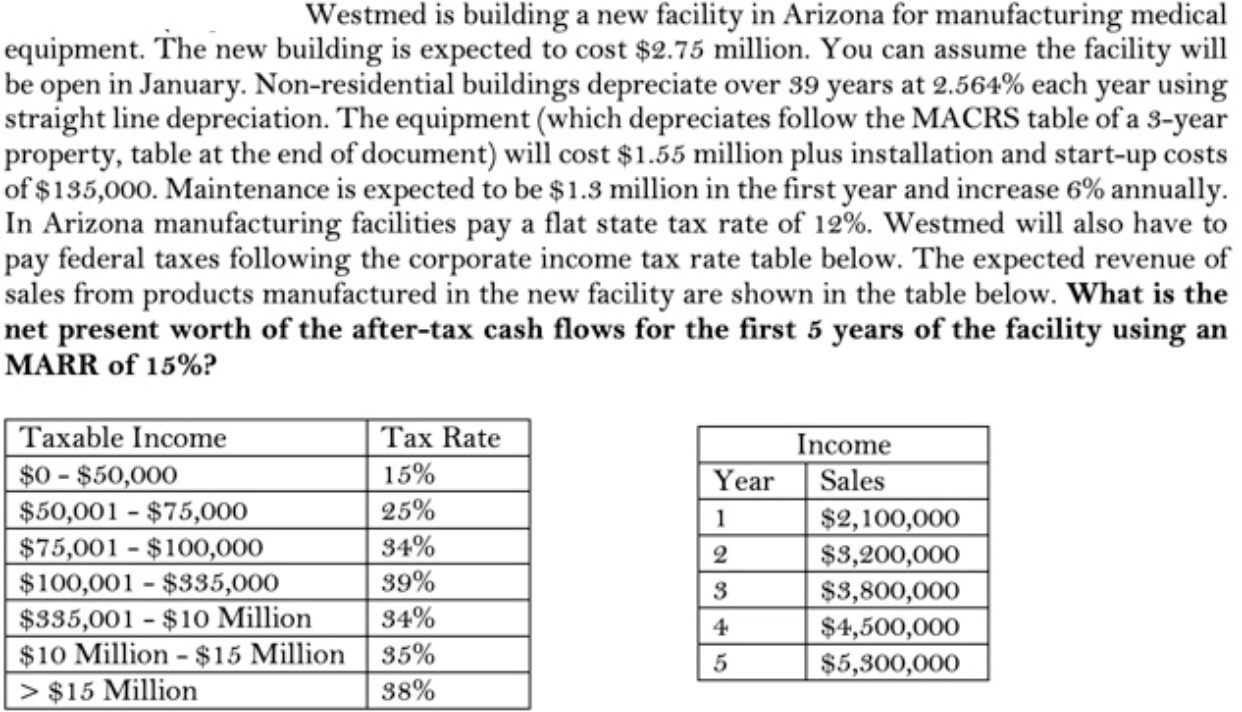

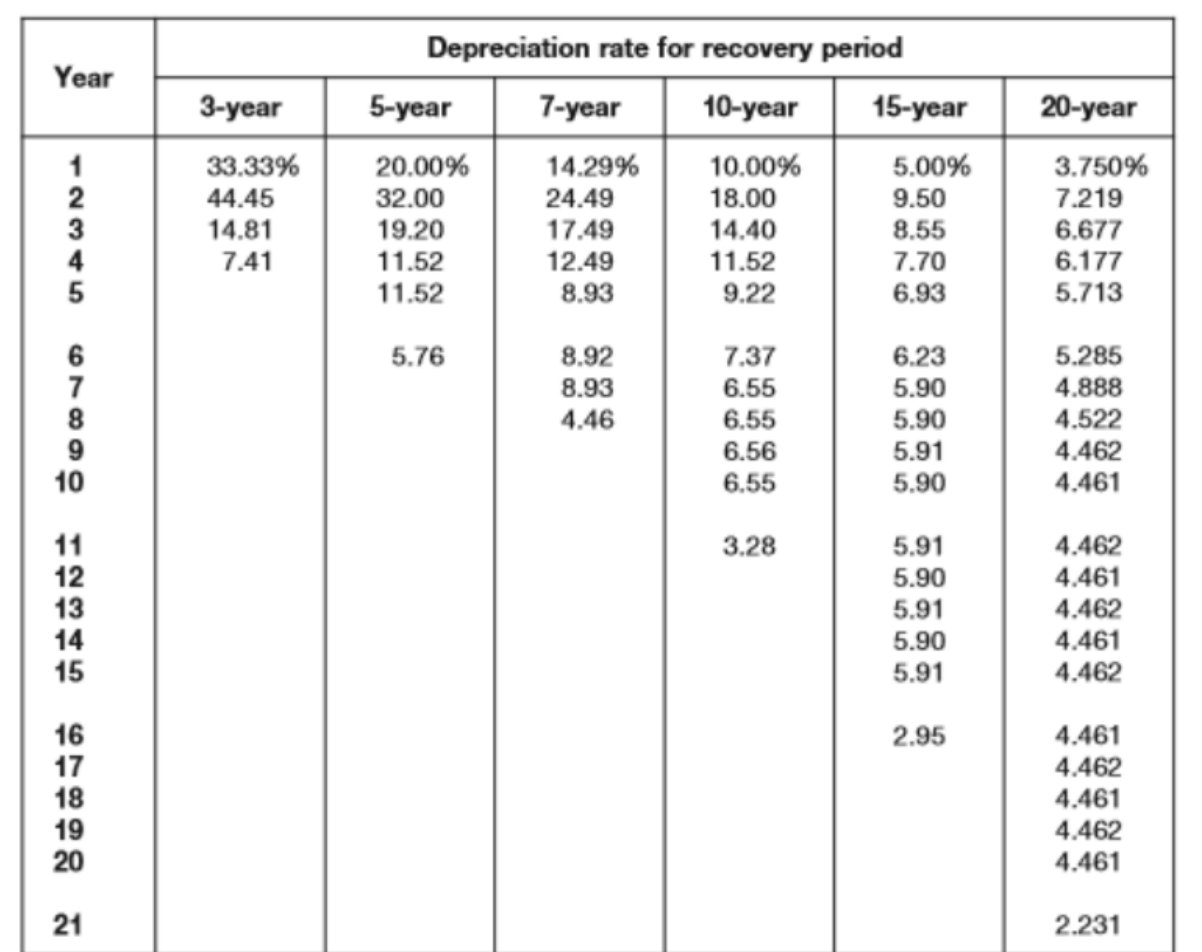

Westmed is building a new facility in Arizona for manufacturing medical equipment. The new building is expected to cost $2.75 million. You can assume the facility will be open in January. Non-residential buildings depreciate over 39 years at 2.564% each year using straight line depreciation. The equipment (which depreciates follow the MACRS table of a 3-year property, table at the end of document) will cost $1.55 million plus installation and start-up costs of $135,000. Maintenance is expected to be $1.3 million in the first year and increase 6% annually. In Arizona manufacturing facilities pay a flat state tax rate of 12%. Westmed will also have to pay federal taxes following the corporate income tax rate table below. The expected revenue of sales from products manufactured in the new facility are shown in the table below. What is the net present worth of the after-tax cash flows for the first 5 years of the facility using an MARR of 15%? Tax Rate 15% 25% 34% Year 1 Taxable Income $0-$50,000 $50,001 - $75,000 $75,001 - $100,000 $100,001 - $335,000 $385,001 - $10 Million $10 Million - $15 Million > $15 Million Income Sales $2,100,000 $3,200,000 $3,800,000 $4,500,000 $5,300,000 39% 3 94% 85% 38% Year Depreciation rate for recovery period 5-year 7-year 10-year 15-year 3-year 20-year 33.33% 44.45 14.81 7.41 20.00% 32.00 19.20 11.52 11.52 14.29% 24.49 17.49 12.49 8.93 10.00% 18.00 14.40 11.52 9.22 5.00% 9.50 8.55 7.70 6.93 3.750% 7.219 6.677 6.177 5.713 5.76 8.92 8.93 4.46 7.37 6.55 6.55 6.56 6.55 6.23 5.90 5.90 5.91 5.90 5.285 4.888 4.522 4.462 4.461 3.28 5.91 5.90 5.91 5.90 5.91 4.462 4.461 4.462 4.461 4.462 2.95 4.461 4.462 4.461 4.462 4.461 2.231 Westmed is building a new facility in Arizona for manufacturing medical equipment. The new building is expected to cost $2.75 million. You can assume the facility will be open in January. Non-residential buildings depreciate over 39 years at 2.564% each year using straight line depreciation. The equipment (which depreciates follow the MACRS table of a 3-year property, table at the end of document) will cost $1.55 million plus installation and start-up costs of $135,000. Maintenance is expected to be $1.3 million in the first year and increase 6% annually. In Arizona manufacturing facilities pay a flat state tax rate of 12%. Westmed will also have to pay federal taxes following the corporate income tax rate table below. The expected revenue of sales from products manufactured in the new facility are shown in the table below. What is the net present worth of the after-tax cash flows for the first 5 years of the facility using an MARR of 15%? Tax Rate 15% 25% 34% Year 1 Taxable Income $0-$50,000 $50,001 - $75,000 $75,001 - $100,000 $100,001 - $335,000 $385,001 - $10 Million $10 Million - $15 Million > $15 Million Income Sales $2,100,000 $3,200,000 $3,800,000 $4,500,000 $5,300,000 39% 3 94% 85% 38% Year Depreciation rate for recovery period 5-year 7-year 10-year 15-year 3-year 20-year 33.33% 44.45 14.81 7.41 20.00% 32.00 19.20 11.52 11.52 14.29% 24.49 17.49 12.49 8.93 10.00% 18.00 14.40 11.52 9.22 5.00% 9.50 8.55 7.70 6.93 3.750% 7.219 6.677 6.177 5.713 5.76 8.92 8.93 4.46 7.37 6.55 6.55 6.56 6.55 6.23 5.90 5.90 5.91 5.90 5.285 4.888 4.522 4.462 4.461 3.28 5.91 5.90 5.91 5.90 5.91 4.462 4.461 4.462 4.461 4.462 2.95 4.461 4.462 4.461 4.462 4.461 2.231

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts