Question: please answer using excel and show formulas. please show how calculate payback and discounted payback TUI These WACCs? Udhd A and B were mutually exclusive,

please answer using excel and show formulas. please show how calculate payback and discounted payback

please answer using excel and show formulas. please show how calculate payback and discounted payback

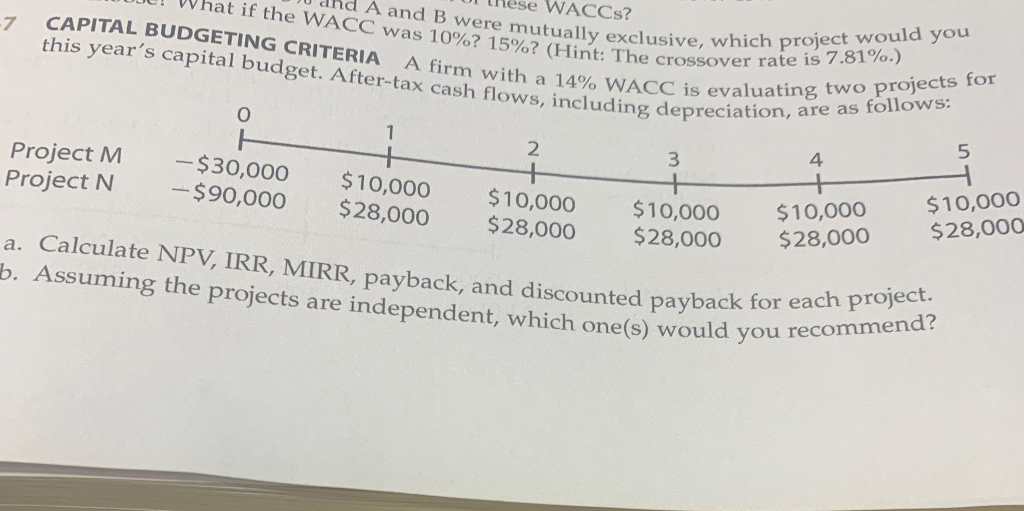

TUI These WACCs? Udhd A and B were mutually exclusive, w UL! What if the WACC was 10%? 15%? (Hint: The crosso CAPITAL BUDGETING CRITERIA A firm with a 14% WACC is this year's capital budget. After-tax cash flows, including depreci clusive, which project would you crossover rate is 7.81%.) CC is evaluating two projects for ing depreciation, are as follows: 5 Project M Project N - $30,000 - $90,000 $10,000 $28,000 $10,000 $28,000 $10,000 $28,000 $10,000 $28,000 $10,000 $28,000 a. Calculate NPV, IRR, MIRR, payback, and discounted payback b. Assuming the projects are independent, which one(s) would yo nted payback for each project. ould you recommend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts