Question: please answer using excel and show work and all formulas. answer all parts please PART 5. LET'S BUY A HOUSE Freddy and Frieda Finance are

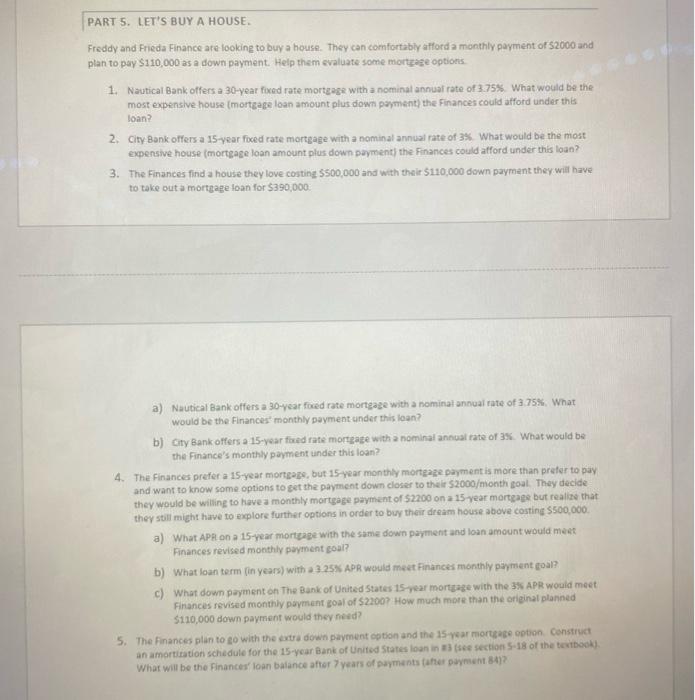

PART 5. LET'S BUY A HOUSE Freddy and Frieda Finance are looking to buy a house. They can comfortably afford a monthly payment of 2000 and plan to pay $110,000 as a down payment. Help them evaluate some mortgage options 1. Nautical Bank offers a 30-year fixed rate mortgage with a nominal annual rate of 3.75% What would be the most expensive house (mortgage loan amount plus down payment) the Finances could afford under this loan? 2. City Bank offers a 15-year foxed rate mortgage with a nominal annual rate of 3% What would be the most expensive house (mortgage loan amount plus down payment) the Finances could afford under this loan? 3. The Finances find a house they love costing 5500,000 and with their $110,000 down payment they will have to take out a mortgage loan for $390,000 a) Nautical Bank offers a 30-year foxed rate mortgage with a nominal annual rate of 3.75%. What would be the Finances monthly payment under this loan? b) City Bank offers a 15-year fed rate mortgage with a nominal annual rate of 3. What would be the Finance's monthly payment under this loan? 4. The Finances prefer a 15-year mortgage, but 15 year monthly mortgage payment is more than prefer to pay and want to know some options to get the payment down closer to their S2000/month goal. They decide they would be willing to have a monthly mortgage payment of $2200 on a 15 year mortgage but realize that they still might have to explore further options in order to buy their dream house above costing 5500,000 a) What APR on a 15-year mortgage with the same down payment and loan amount would meet Finances revised monthly payment goal? b) What loan term (in years) with a 3 25% APR would meet Finances monthly payment goal? c) What down payment on The Bank of United States 15-year mortgage with the 3 APR would meet Finances revised monthly payment goal of $22007 How much more than the original planned $110,000 down payment would they need? 5. The Finances plan to go with the extra down payment option and the 15-year mortgage option Construct an amortization schedule for the 15-year Bank of United States loan in (see section 5-18 of the textbook What will be the finances' loan balance after years of payments the payment 84)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts