Question: Please answer using excel, and showing the excel functions/equations. 10. Valuing Callable Bonds Bandon Manufacturing intends to issue callable, perpetual bonds with annual coupon payments

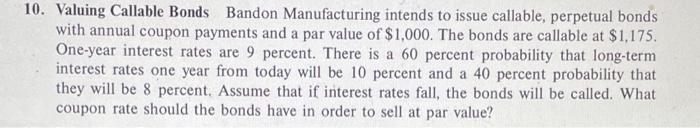

10. Valuing Callable Bonds Bandon Manufacturing intends to issue callable, perpetual bonds with annual coupon payments and a par value of $1,000. The bonds are callable at $1,175. One-year interest rates are 9 percent. There is a 60 percent probability that long-term interest rates one year from today will be 10 percent and a 40 percent probability that they will be 8 percent. Assume that if interest rates fall, the bonds will be called. What coupon rate should the bonds have in order to sell at par value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts