Question: PLEASE ANSWER USING EXCEL AND USE FORMULA TEXT 2. Consider the following statistics for a portfolio composed of shares of Companies A and B: Company

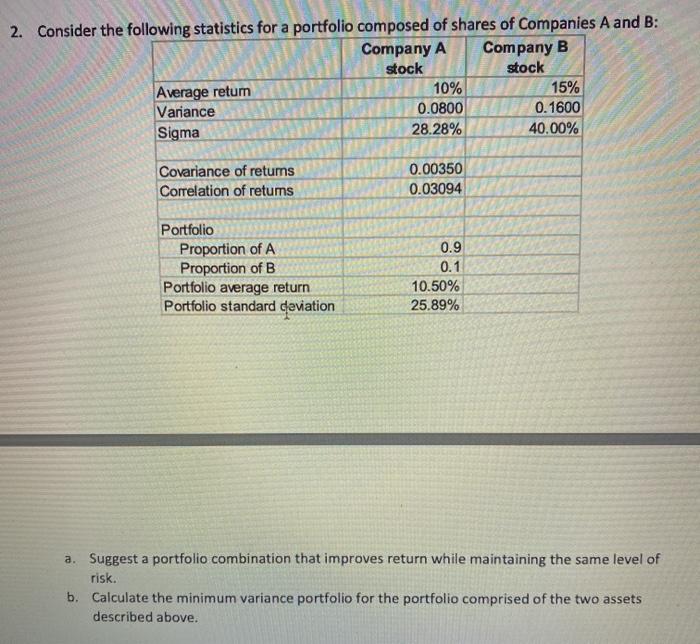

2. Consider the following statistics for a portfolio composed of shares of Companies A and B: Company A Company B stock stock Average retum 10% 15% Variance 0.0800 0.1600 Sigma 28.28% 40.00% Covariance of retums Correlation of retums 0.00350 0.03094 Portfolio Proportion of A Proportion of B Portfolio average return Portfolio standard deviation 0.9 0.1 10.50% 25.89% a. Suggest a portfolio combination that improves return while maintaining the same level of risk. b. Calculate the minimum variance portfolio for the portfolio comprised of the two assets described above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts