Question: please answer using excel formuals Use the following information to answer questions #7 and #8: Consider a 10-year bond making annual coupon payments at a

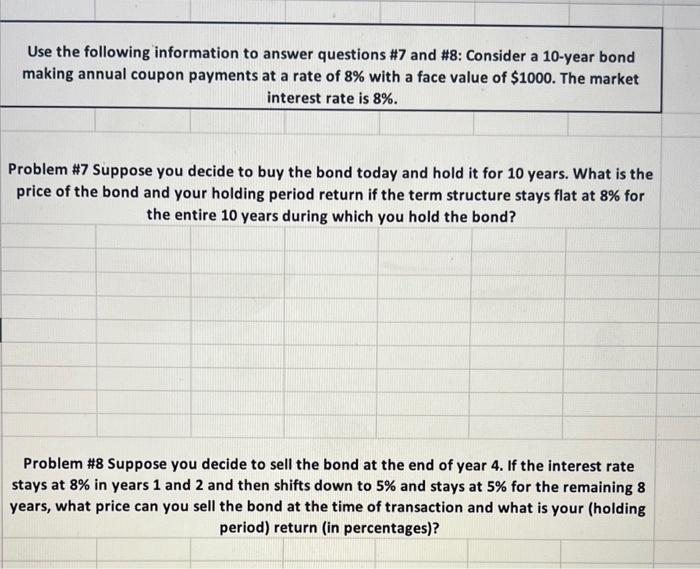

Use the following information to answer questions \#7 and \#8: Consider a 10-year bond making annual coupon payments at a rate of 8% with a face value of $1000. The market interest rate is 8%. Problem \#7 Suppose you decide to buy the bond today and hold it for 10 years. What is the price of the bond and your holding period return if the term structure stays flat at 8% for the entire 10 years during which you hold the bond? Problem \#8 Suppose you decide to sell the bond at the end of year 4 . If the interest rate stays at 8% in years 1 and 2 and then shifts down to 5% and stays at 5% for the remaining 8 years, what price can you sell the bond at the time of transaction and what is your (holding period) return (in percentages)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts