Question: Please answer using Excel formulas and showing work if possible Complete problem: Premium for Financial Risk XYZ , Inc. has an unlevered beta of 1

Please answer using Excel formulas and showing work if possible

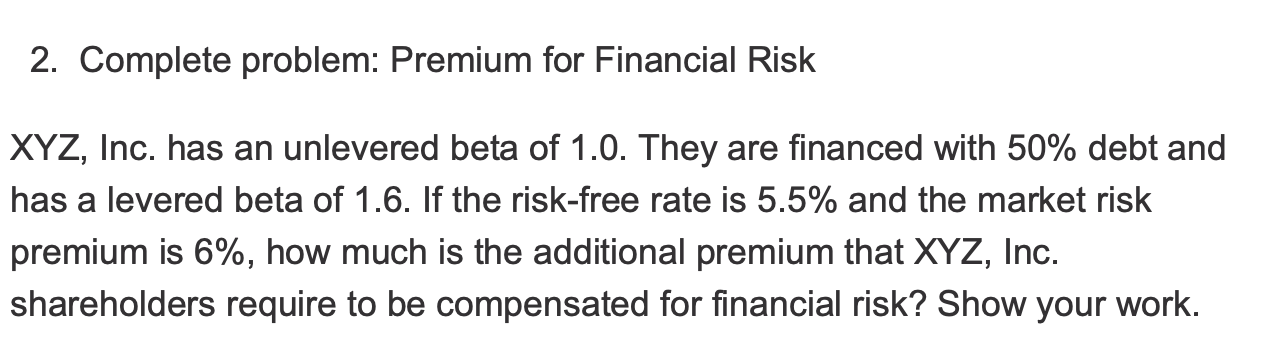

Complete problem: Premium for Financial Risk

XYZ Inc. has an unlevered beta of They are financed with debt and

has a levered beta of If the riskfree rate is and the market risk

premium is how much is the additional premium that XYZ Inc.

shareholders require to be compensated for financial risk? Show your work.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock