Question: Please answer using excel. Thank you Q1.: At the beginning of its fiscal year 2021, an analyst made the following forecast for Generic Inc., the

Please answer using excel. Thank you

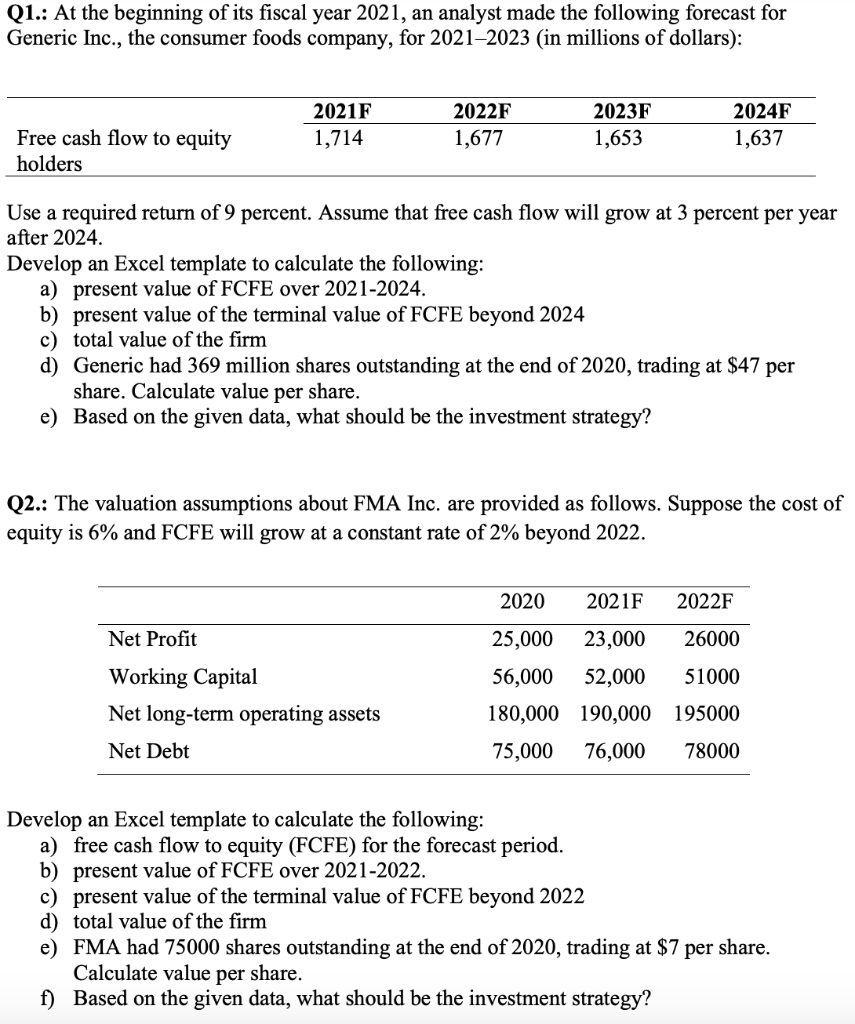

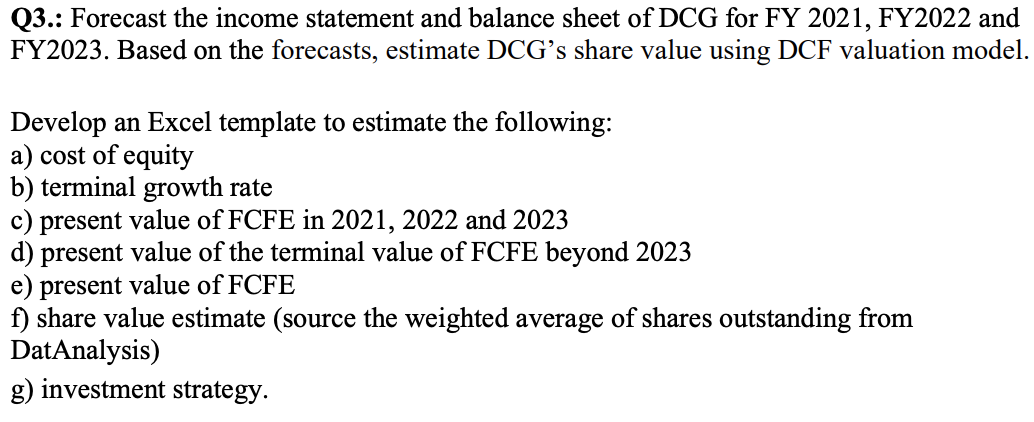

Q1.: At the beginning of its fiscal year 2021, an analyst made the following forecast for Generic Inc., the consumer foods company, for 2021-2023 (in millions of dollars): 2021F 1,714 2022F 1,677 Free cash flow to equity holders 2023F 1,653 2024F 1,637 Use a required return of 9 percent. Assume that free cash flow will grow at 3 percent per year after 2024. Develop an Excel template to calculate the following: a) present value of FCFE over 2021-2024. b) present value of the terminal value of FCFE beyond 2024 c) total value of the firm d) Generic had 369 million shares outstanding at the end of 2020, trading at $47 per share. Calculate value per share. e) Based on the given data, what should be the investment strategy? Q2.: The valuation assumptions about FMA Inc. are provided as follows. Suppose the cost of equity is 6% and FCFE will grow at a constant rate of 2% beyond 2022. 2020 2021F 2022F Net Profit Working Capital Net long-term operating assets Net Debt 25,000 23,000 26000 56,000 52,000 51000 180,000 190,000 195000 75,000 76,000 78000 Develop an Excel template to calculate the following: a) free cash flow to equity (FCFE) for the forecast period. b) present value of FCFE over 2021-2022. c) present value of the terminal value of FCFE beyond 2022 d) total value of the firm e) FMA had 75000 shares outstanding at the end of 2020, trading at $7 per share. Calculate value per share. f) Based on the given data, what should be the investment strategy? Q3.: Forecast the income statement and balance sheet of DCG for FY 2021, FY2022 and FY2023. Based on the forecasts, estimate DCG's share value using DCF valuation model. Develop an Excel template to estimate the following: a) cost of equity b) terminal growth rate c) present value of FCFE in 2021, 2022 and 2023 d) present value of the terminal value of FCFE beyond 2023 e) present value of FCFE f) share value estimate (source the weighted average of shares outstanding from DatAnalysis) g) investment strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts