Question: please answer using financial calculator with steps A property is available for sale that could normally be financed with a fully amortizing $80,000 loan at

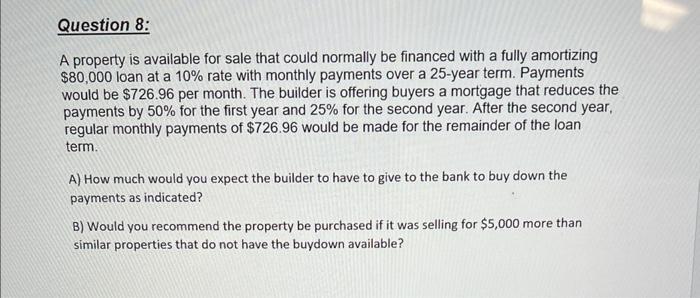

A property is available for sale that could normally be financed with a fully amortizing $80,000 loan at a 10% rate with monthly payments over a 25 -year term. Payments would be $726.96 per month. The builder is offering buyers a mortgage that reduces the payments by 50% for the first year and 25% for the second year. After the second year, regular monthly payments of $726.96 would be made for the remainder of the loan term. A) How much would you expect the builder to have to give to the bank to buy down the payments as indicated? B) Would you recommend the property be purchased if it was selling for $5,000 more than similar properties that do not have the buydown available

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts