Question: please answer using financial formulas and not in excel a more clearer pic above Lab 5 Questions Name Question 2-Solving for Payment * Suppose you

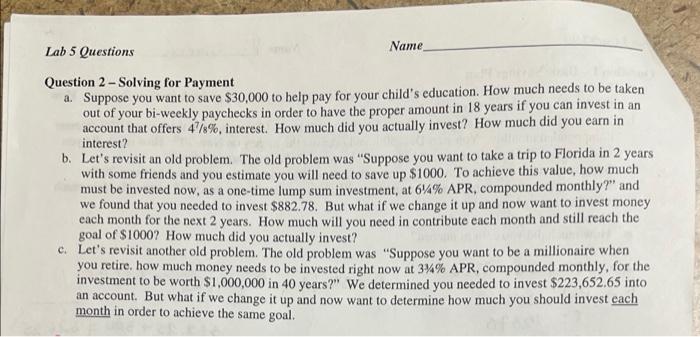

Lab 5 Questions Name Question 2-Solving for Payment * Suppose you want to save $30,000 to help pay for your child's education. How much needs to be taken out of your bi-weekly paychecks in order to have the proper amount in 18 years if you can invest in an account that offers 4%, interest. How much did you actually invest? How much did you earn in interest? b. Let's revisit an old problem. The old problem was "Suppose you want to take a trip to Florida in 2 years with some friends and you estimate you will need to save up $1000. To achieve this value, how much must be invested now, as a one-time lump sum investment, at 64% APR, compounded monthly?" and we found that you needed to invest $882.78. But what if we change it up and now want to invest money each month for the next 2 years. How much will you need in contribute each month and still reach the goal of $1000? How much did you actually invest? c. Let's revisit another old problem. The old problem was "Suppose you want to be a millionaire when you retire, how much money needs to be invested right now at 3% APR, compounded monthly, for the investment to be worth $1,000,000 in 40 years?" We determined you needed to invest $223,652.65 into an account. But what if we change it up and now want to determine how much you should invest cach month in order to achieve the same goal. Lab 5 Questions Name Question 2-Solving for Payment a. Suppose you want to save $30,000 to help pay for your child's education. How much needs to be taken out of your bi-weekly paychecks in order to have the proper amount in 18 years if you can invest in an account that offers 47/8%, interest. How much did you actually invest? How much did you earn in interest? b. Let's revisit an old problem. The old problem was "Suppose you want to take a trip to Florida in 2 years with some friends and you estimate you will need to save up $1000. To achieve this value, how much must be invested now, as a one-time lump sum investment, at 64% APR, compounded monthly?" and we found that you needed to invest $882.78. But what if we change it up and now want to invest money each month for the next 2 years. How much will you need in contribute each month and still reach the goal of $1000? How much did you actually invest? c. Let's revisit another old problem. The old problem was "Suppose you want to be a millionaire when you retire. how much money needs to be invested right now at 34% APR, compounded monthly, for the investment to be worth $1,000,000 in 40 years?" We determined you needed to invest $223,652.65 into an account. But what if we change it up and now want to determine how much you should invest each month in order to achieve the same goal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts