Question: Please answer using Google spreadsheets. The Banff Gondola is looking to increase its operational capacity through modifications to its gondola equipment. If it invests $2.3

Please answer using Google spreadsheets.

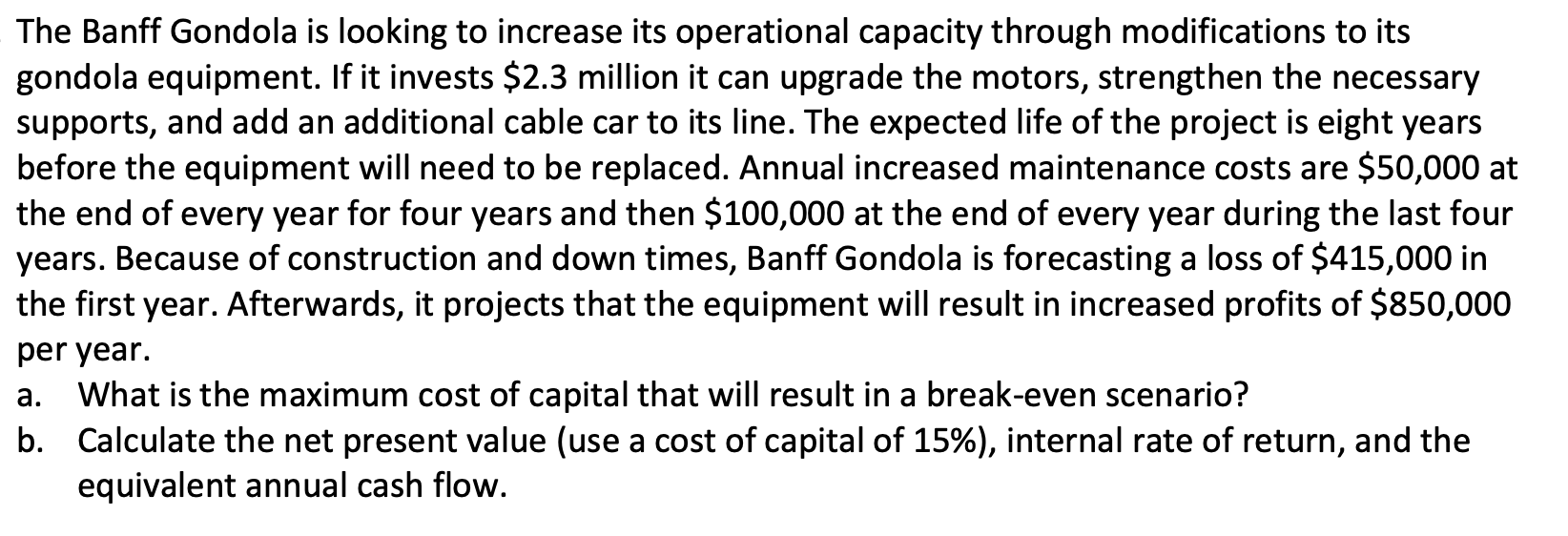

The Banff Gondola is looking to increase its operational capacity through modifications to its gondola equipment. If it invests $2.3 million it can upgrade the motors, strengthen the necessary supports, and add an additional cable car to its line. The expected life of the project is eight years before the equipment will need to be replaced. Annual increased maintenance costs are $50,000 at the end of every year for four years and then $100,000 at the end of every year during the last four years. Because of construction and down times, Banff Gondola is forecasting a loss of $415,000 in the first year. Afterwards, it projects that the equipment will result in increased profits of $850,000 per year. a. What is the maximum cost of capital that will result in a break-even scenario? b. Calculate the net present value (use a cost of capital of 15%), internal rate of return, and the equivalent annual cash flow. a The Banff Gondola is looking to increase its operational capacity through modifications to its gondola equipment. If it invests $2.3 million it can upgrade the motors, strengthen the necessary supports, and add an additional cable car to its line. The expected life of the project is eight years before the equipment will need to be replaced. Annual increased maintenance costs are $50,000 at the end of every year for four years and then $100,000 at the end of every year during the last four years. Because of construction and down times, Banff Gondola is forecasting a loss of $415,000 in the first year. Afterwards, it projects that the equipment will result in increased profits of $850,000 per year. a. What is the maximum cost of capital that will result in a break-even scenario? b. Calculate the net present value (use a cost of capital of 15%), internal rate of return, and the equivalent annual cash flow. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts