Question: please answer what you can see please do the ones you can see Cap Valuatio Vale a three year Ins tres show bow with a

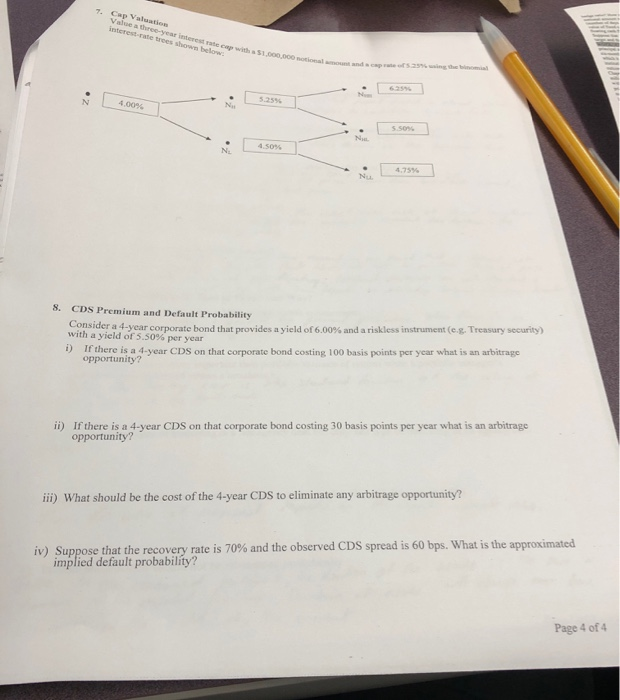

Cap Valuatio Vale a three year Ins tres show bow with a $1.000.000 I s.son : 4.50% Nu 8. CDS Premium and Default Probability Consider a 4-year corporate bond that provides a yield of 6.00% and a riskless instrumente Treasury security with a yield of 5 50% per year 1) If there is a 4-year CDS on that corporate bond costing 100 basis points per year what is an arbitrage opportunity? ii) If there is a 4-year CDS on that corporate bond costing 30 basis points per year what is an arbitrage opportunity? iii) What should be the cost of the 4-year CDS to eliminate any arbitrage opportunity? iv) Suppose that the recovery rate is 70% and the observed CDS spread is 60 bps. What is the approximated implied default probability? Page 4 of 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts