Question: Please answer Why would Milton need to file a Schedule D and form 6251 for the problem below? and Form 8826 (disabled access credit). Show

Please answer Why would Milton need to file a Schedule D and form 6251 for the problem below?

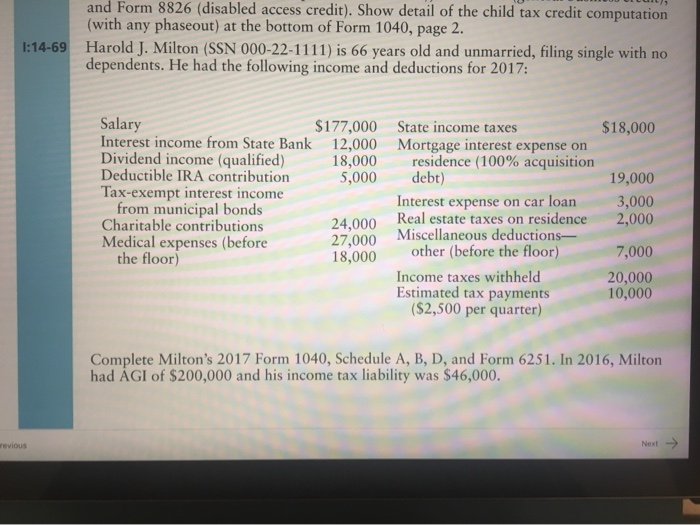

and Form 8826 (disabled access credit). Show detail of the child tax credit computation (with any phaseout) at the bottom of Form 1040, page 2. Harold J. Milton (SSN 000-22-1111) is 66 years old and unmarried, filing single with no dependents. He had the following income and deductions for 2017: 1:14-69 $18,000 Salary $177,000 Interest income from State Bank 12,000 Dividend income (qualified) 18,000 Deductible IRA contribution 5,000 Tax-exempt interest income from municipal bonds Charitable contributions 24,000 27.000 Medical expenses (before the floor) 18,000 State income taxes Mortgage interest expense on residence (100% acquisition debt) Interest expense on car loan Real estate taxes on residence Miscellaneous deductions other before the floor) 19,000 3,000 2,000 7,000 Income taxes withheld Estimated tax payments ($2,500 per quarter) 20,000 10,000 Complete Milton's 2017 Form 1040, Schedule A, B, D, and Form 6251. In 2016, Milton had AGI of $200,000 and his income tax liability was $46,000. revious Next > and Form 8826 (disabled access credit). Show detail of the child tax credit computation (with any phaseout) at the bottom of Form 1040, page 2. Harold J. Milton (SSN 000-22-1111) is 66 years old and unmarried, filing single with no dependents. He had the following income and deductions for 2017: 1:14-69 $18,000 Salary $177,000 Interest income from State Bank 12,000 Dividend income (qualified) 18,000 Deductible IRA contribution 5,000 Tax-exempt interest income from municipal bonds Charitable contributions 24,000 27.000 Medical expenses (before the floor) 18,000 State income taxes Mortgage interest expense on residence (100% acquisition debt) Interest expense on car loan Real estate taxes on residence Miscellaneous deductions other before the floor) 19,000 3,000 2,000 7,000 Income taxes withheld Estimated tax payments ($2,500 per quarter) 20,000 10,000 Complete Milton's 2017 Form 1040, Schedule A, B, D, and Form 6251. In 2016, Milton had AGI of $200,000 and his income tax liability was $46,000. revious Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts