Question: PLEASE ANSWER WILL GIVE THUMBS UP Yield to Maturity and Required Returns The Brownstone Corporation's bonds have 6 years remaining to maturity. Interest is paid

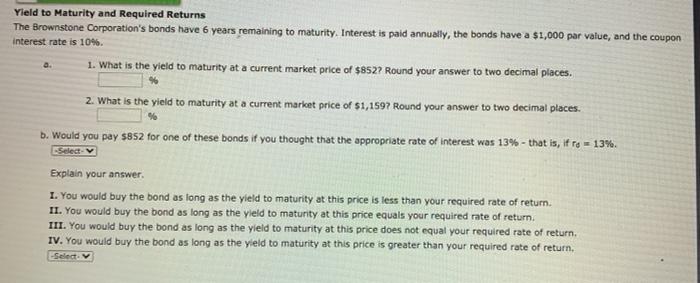

Yield to Maturity and Required Returns The Brownstone Corporation's bonds have 6 years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 10%. 1. What is the yield to maturity at a current market price of $852? Round your answer to two decimal places. 2. What is the yield to maturity at a current market price of $1,1597 Round your answer to two decimal places. b. Would you pay $852 for one of these bonds if you thought that the appropriate rate of interest was 13% - that is, if fo = 13%. Select- Explain your answer. I. You would buy the bond as long as the yield to maturity at this price is less than your required rate of return. 11. You would buy the bond as long as the yield to maturity at this price equals your required rate of return. III. You would buy the bond as long as the yield to maturity at this price does not equal your required rate of return IV. You would buy the bond as long as the yield to maturity at this price is greater than your required rate of return. Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts