Question: please answer, will rate. s Acct 222 Problem 7 E8-43B Analyze outsourcing decision (5 points) McCall Enterprises manufactures one of the component, based on the

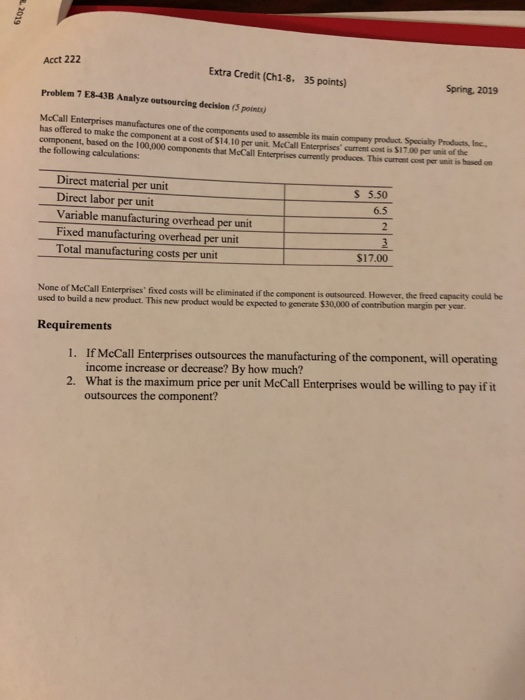

s Acct 222 Problem 7 E8-43B Analyze outsourcing decision (5 points) McCall Enterprises manufactures one of the component, based on the 100,000 components that McCall Enterprises curently prodan Thaanaa pasm Extra Credit (Ch1-8. 35 points) Spring, 2019 components used to assemble its main company product. Specialty Products, Inc. the component at a cost of $14.10 per unit. McCall Enterprises' current cost is $17.00 per unit of the the following calculations: Direct material per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit Total manufacturing costs per unit S 5.50 3 $17.00 None of McCall Enterprises fixed costs will be climinated if the component is used to build a new product. This new prodact would be expected to generate $30,000 of cotribution margin per year outsourced. However, the freed capacity could be Requirements 1. If McCall Enterprises outsources the manufacturing of the component, will operating income increase or decrease? By how much? What is the maximum price per unit McCall Enterprises would be willing to pay if it outsources the component? 2. s Acct 222 Problem 7 E8-43B Analyze outsourcing decision (5 points) McCall Enterprises manufactures one of the component, based on the 100,000 components that McCall Enterprises curently prodan Thaanaa pasm Extra Credit (Ch1-8. 35 points) Spring, 2019 components used to assemble its main company product. Specialty Products, Inc. the component at a cost of $14.10 per unit. McCall Enterprises' current cost is $17.00 per unit of the the following calculations: Direct material per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit Total manufacturing costs per unit S 5.50 3 $17.00 None of McCall Enterprises fixed costs will be climinated if the component is used to build a new product. This new prodact would be expected to generate $30,000 of cotribution margin per year outsourced. However, the freed capacity could be Requirements 1. If McCall Enterprises outsources the manufacturing of the component, will operating income increase or decrease? By how much? What is the maximum price per unit McCall Enterprises would be willing to pay if it outsources the component? 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts