Question: Please answer will thumbs up thanks Consider a stock that pays no dividends on which a futures contract, a call option and a put option

Please answer will thumbs up thanks

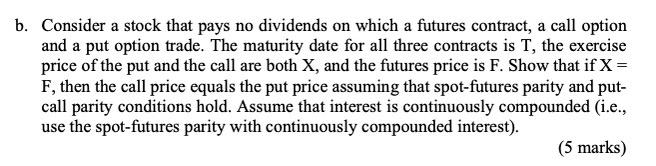

Consider a stock that pays no dividends on which a futures contract, a call option and a put option trade. The maturity date for all three contracts is T, the exercise price of the put and the call are both X, and the futures price is F. Show that if X= F, then the call price equals the put price assuming that spot-futures parity and putcall parity conditions hold. Assume that interest is continuously compounded (i.e., use the spot-futures parity with continuously compounded interest)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts