Question: PLEASE ANSWER WILL UPVOTE Please show excel formula or how to found the answer WPP, Inc. is a wireless network provider and it is considering

PLEASE ANSWER WILL UPVOTE

Please show excel formula or how to found the answer

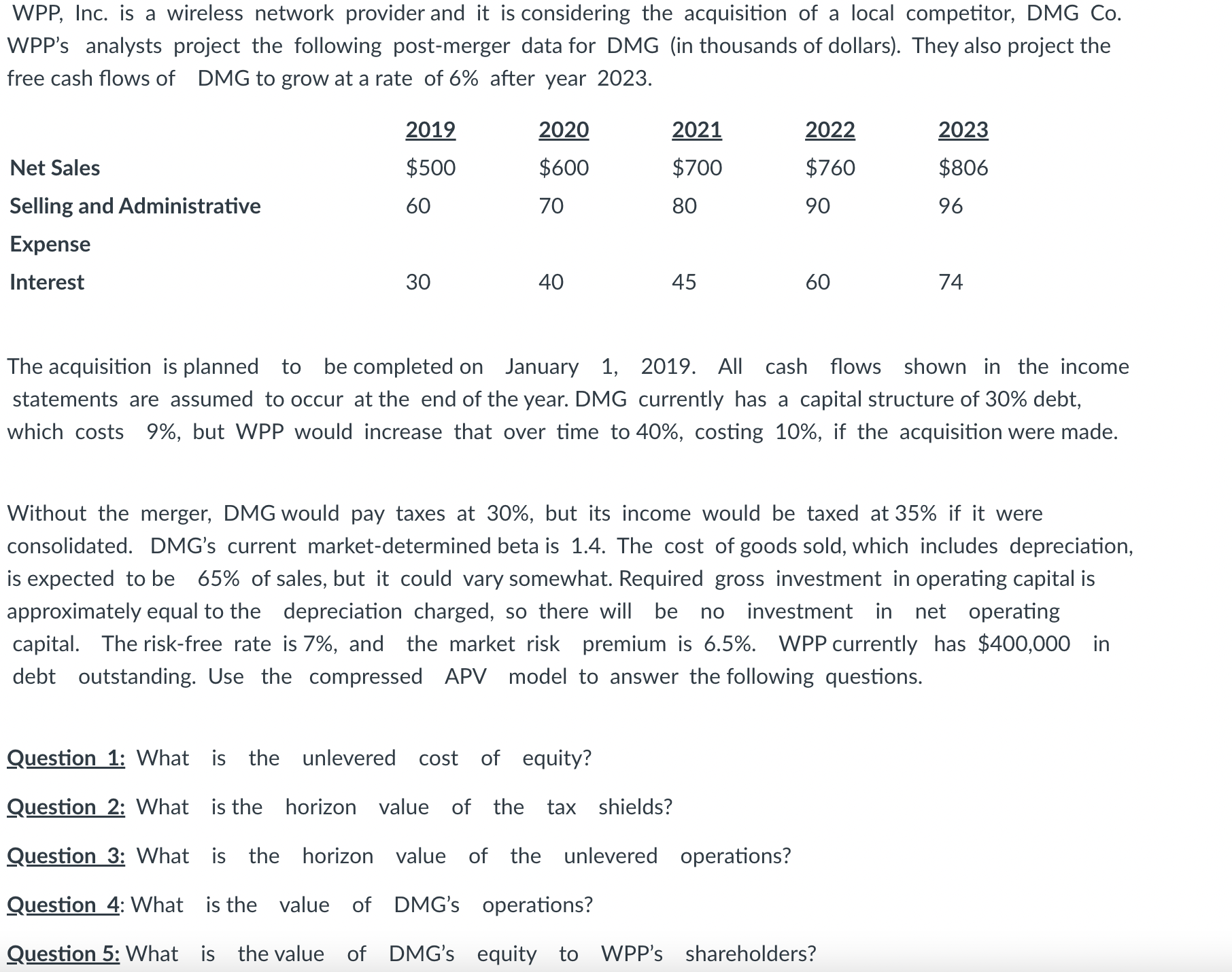

WPP, Inc. is a wireless network provider and it is considering the acquisition of a local competitor, DMG Co. WPP's analysts project the following post-merger data for DMG (in thousands of dollars). They also project the free cash flows of DMG to grow at a rate of 6% after year 2023. The acquisition is planned to be completed on January 1, 2019. All cash flows shown in the income statements are assumed to occur at the end of the year. DMG currently has a capital structure of 30% debt, which costs 9%, but WPP would increase that over time to 40%, costing 10%, if the acquisition were made. Without the merger, DMG would pay taxes at 30%, but its income would be taxed at 35% if it were consolidated. DMG's current market-determined beta is 1.4. The cost of goods sold, which includes depreciation, is expected to be 65% of sales, but it could vary somewhat. Required gross investment in operating capital is approximately equal to the depreciation charged, so there will be no investment in net operating capital. The risk-free rate is 7%, and the market risk premium is 6.5%. WPP currently has $400,000 in debt outstanding. Use the compressed APV model to answer the following questions. Question 1: What is the unlevered cost of equity? Question 2: What is the horizon value of the tax shields? Question 3: What is the horizon value of the unlevered operations? Question 4: What is the value of DMG's operations? Question 5: What is the value of DMG's equity to WPP's shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts