Question: Please answer with an explanation for question 1 & the use of the financial keys on the calculator for question 2. Thank you 1. You

Please answer with an explanation for question 1 & the use of the financial keys on the calculator for question 2. Thank you

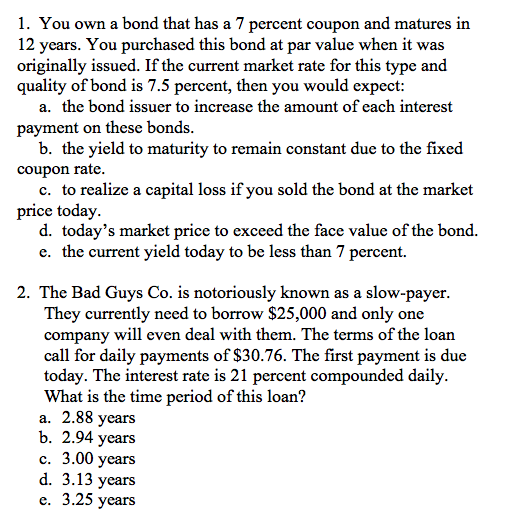

1. You own a bond that has a 7 percent coupon and matures irn 12 years. You purchased this bond at par value when it was originally issued. If the current market rate for this type and quality of bond is 7.5 percent, then you would expect payment on these bonds coupon rate price today a. the bond issuer to increase the amount of each interest b. the yield to maturity to remain constant due to the fixed c. to realize a capital loss if you sold the bond at the market d. today's market price to exceed the face value of the bond. e. the current yield today to be less than 7 percent. 2. The Bad Guys Co. is notoriously known as a slow-payer They currently need to borrow $25,000 and only one company will even deal with them. The terms of the loan call for daily payments of $30.76. The first payment is due today. The interest rate is 21 percent compounded daily What is the time period of this loan? a. 2.88 years b. 2.94 years c. 3.00 years d. 3.13 years e. 3.25 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts