Question: please answer with as much detail as possible. Also please explain your calculations one step at a time as well. thank you MINICASE Mark and

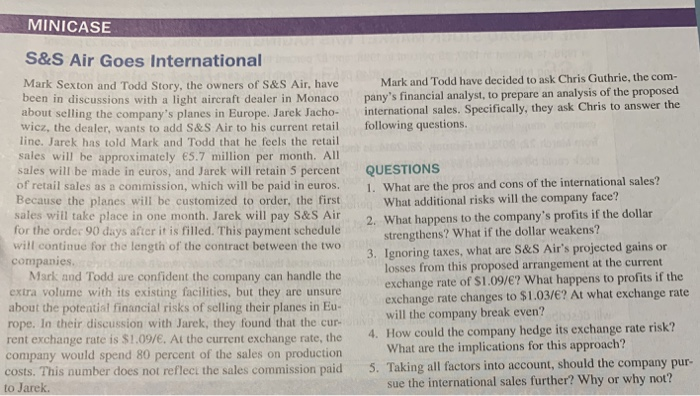

MINICASE Mark and Todd have decided to ask Chris Guthrie, the com- pany's financial analyst, to prepare an analysis of the proposed international sales. Specifically, they ask Chris to answer the following questions S&S Air Goes International Mark Sexton and Todd Story, the owners of S&S Air, have been in discussions with a light aircraft dealer in Monaco about selling the company's planes in Europe. Jarek Jacho- wicz, the dealer, wants to add S&S Air to his current retail line. Jarek has told Mark and Todd that he feels the retail sales will be approximately 5.7 million per month. All sales will be made in euros, and Jarek will retain 5 percent of retail sales as a commission, which will be paid in euros. Because the planes will be customized to order, the first sales will take place in one month. Jarek will pay S&S Air for the order 90 days after it is filled. This payment schedule will continue for the length of the contract between the two companies Mark and Todd are confident the company can handle the extra volume with its existing facilities, but they are unsure about the potential financial risks of selling their planes in Eu- rope. In their discussion with Jarek, they found that the cur rent exchange rate is $1.09/. At the current exchange rate, the company would spend 80 percent of the sales on production costs. This number does not reflect the sales commission paid to Jarek. QUESTIONS 1. What are the pros and cons of the international sales? What additional risks will the company face? 2. What happens to the company's profits if the dollar strengthens? What if the dollar weakens? 3. Ignoring taxes, what are S&S Air's projected gains or losses from this proposed arrangement at the current exchange rate of $1.09/? What happens to profits if the exchange rate changes to $1.03/? At what exchange rate will the company break even? 4. How could the company hedge its exchange rate risk? What are the implications for this approach? 5. Taking all factors into account, should the company pur- sue the international sales further? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts