Question: Please answer with clear image if you are using handwriting. Thank you 2. Selamat Sdn. Bhd., a licensed person under the Service Tax Act 2018

Please answer with clear image if you are using handwriting. Thank you

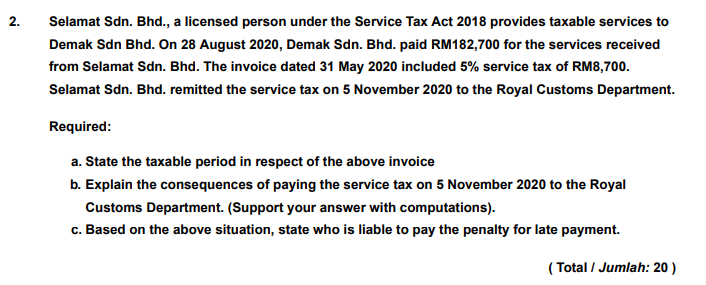

2. Selamat Sdn. Bhd., a licensed person under the Service Tax Act 2018 provides taxable services to Demak Sdn Bhd. On 28 August 2020, Demak Sdn. Bhd. paid RM182,700 for the services received from Selamat Sdn. Bhd. The invoice dated 31 May 2020 included 5% service tax of RM8,700. Selamat Sdn. Bhd. remitted the service tax on 5 November 2020 to the Royal Customs Department. Required: a. State the taxable period in respect of the above invoice b. Explain the consequences of paying the service tax on 5 November 2020 to the Royal Customs Department. (Support your answer with computations). c. Based on the above situation, state who is liable to pay the penalty for late payment. (Total / Jumlah: 20 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts