Question: Please answer with detailed calculations and good formatting and make sure the answer is 100% correct, else leave it for the other tutor to answer.

Please answer with detailed calculations and good formatting and make sure the answer is 100% correct, else leave it for the other tutor to answer. Otherwise i will downvote the answer and report it for uprofessionalism for sure. Please don't use AI or Chat GPT also make sure there is no plagiari.sm.

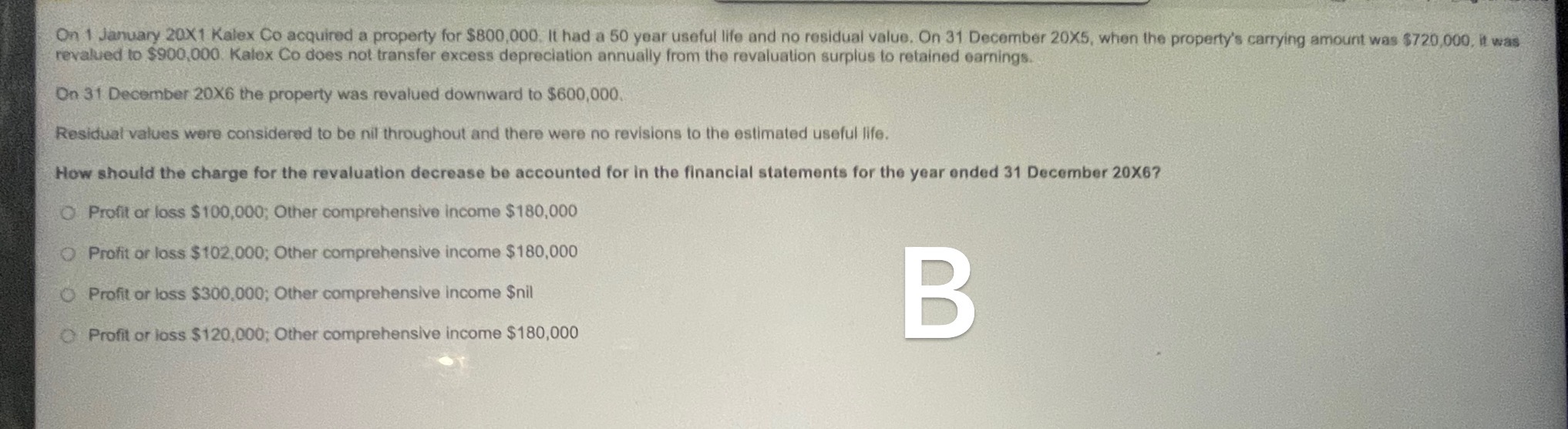

On 1 January 20X 1 Kalex Co acquired a property for $800,000. It had a 50 year useful life and no residual value. On 31 December 20X5, when the property's carrying amount was $720,000, it was revalued to $900,000. Kalex Co does not transfer excess depreciation annually from the revaluation surplus to retained earnings. On 31 December 20X6 the property was revalued downward to $600,000. Residual values were considered to be nil throughout and there were no revisions to the estimated useful life. How should the charge for the revaluation decrease be accounted for in the financial statements for the year ended 31 December 20X6? Profit or loss $100,000; Other comprehensive income $180,000 Profit or loss $102,000; Other comprehensive income $180,000 Profit or loss $300,000; Other comprehensive income $nil B Profit or loss $120,000; Other comprehensive income $180,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts