Question: please answer with equations included! 9. Leverage and the Cost of Capital. The common stock and debt of Northern Sludge are valued at $70 million

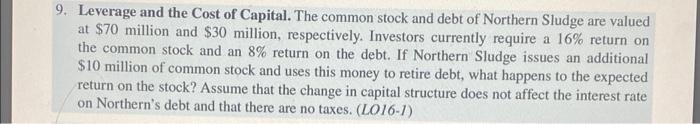

9. Leverage and the Cost of Capital. The common stock and debt of Northern Sludge are valued at $70 million and $30 million, respectively. Investors currently require a 16% return on the common stock and an 8% return on the debt. If Northern Sludge issues an additional $10 million of common stock and uses this money to retire debt, what happens to the expected return on the stock? Assume that the change in capital structure does not affect the interest rate on Northern's debt and that there are no taxes. (LO16-l)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts