Question: Please answer with excel 21. You borrow $10,000 from a bank. You agree to pay $1,250 every six months for the next five years. What

Please answer with excel

Please answer with excel

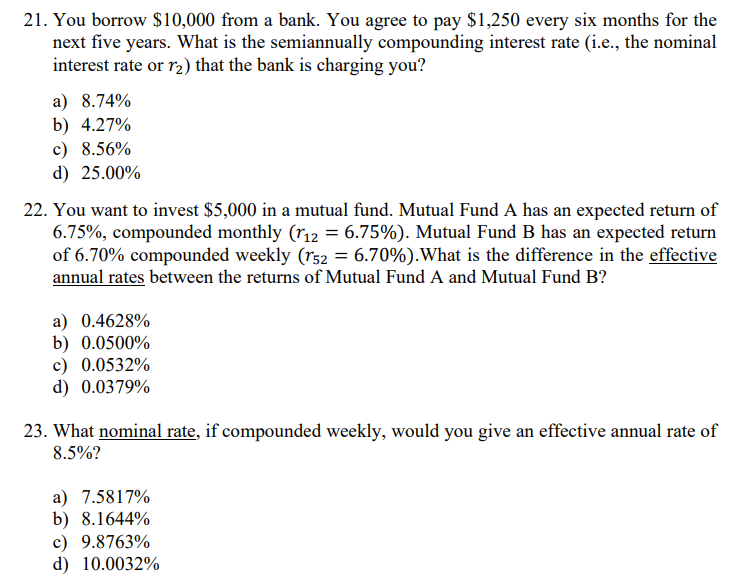

21. You borrow $10,000 from a bank. You agree to pay $1,250 every six months for the next five years. What is the semiannually compounding interest rate (i.e., the nominal interest rate or r2) that the bank is charging you? a) 8.74% b) 4.27% c) 8.56% d) 25.00% 22. You want to invest $5,000 in a mutual fund. Mutual Fund A has an expected return of 6.75%, compounded monthly (r12 = 6.75%). Mutual Fund B has an expected return of 6.70% compounded weekly (r52 = 6.70%). What is the difference in the effective annual rates between the returns of Mutual Fund A and Mutual Fund B? a) 0.4628% b) 0.0500% c) 0.0532% d) 0.0379% 23. What nominal rate, if compounded weekly, would you give an effective annual rate of 8.5%? a) 7.5817% b) 8.1644% c) 9.8763% d) 10.0032%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts