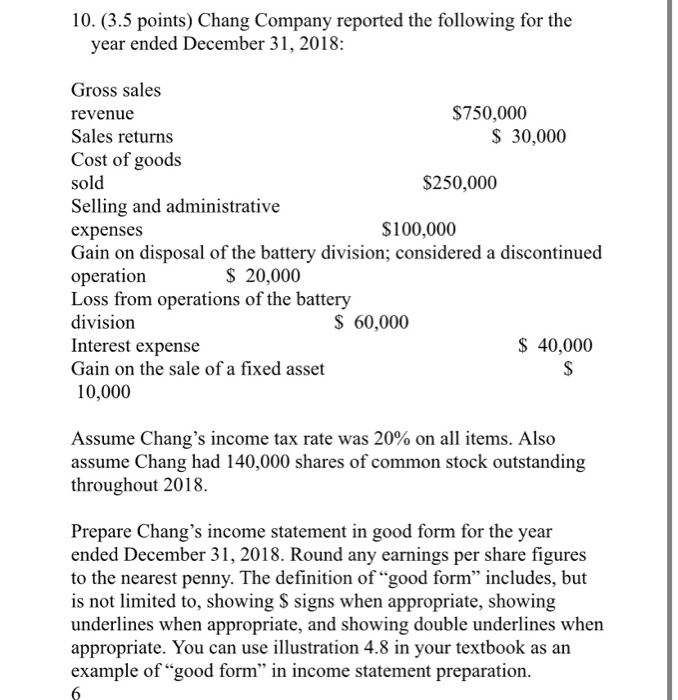

Question: please answer with explaination 10. (3.5 points) Chang Company reported the following for the year ended December 31, 2018: Gross sales revenue $750,000 Sales returns

10. (3.5 points) Chang Company reported the following for the year ended December 31, 2018: Gross sales revenue $750,000 Sales returns $ 30,000 Cost of goods sold $250,000 Selling and administrative expenses $100,000 Gain on disposal of the battery division; considered a discontinued operation $ 20,000 Loss from operations of the battery division $ 60,000 Interest expense $ 40,000 Gain on the sale of a fixed asset $ 10,000 Assume Chang's income tax rate was 20% on all items. Also assume Chang had 140,000 shares of common stock outstanding throughout 2018. Prepare Chang's income statement in good form for the year ended December 31, 2018. Round any earnings per share figures to the nearest penny. The definition of good form includes, but is not limited to, showing $ signs when appropriate, showing underlines when appropriate, and showing double underlines when appropriate. You can use illustration 4.8 in your textbook as an example of good form in income statement preparation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts