Question: PLEASE ANSWER WITH EXPLANATION. Comparing Firms Using Ratio Analysis Consider the following data for several firms from 2013 ($ millions): Proceeds Average current Cash from

PLEASE ANSWER WITH EXPLANATION.

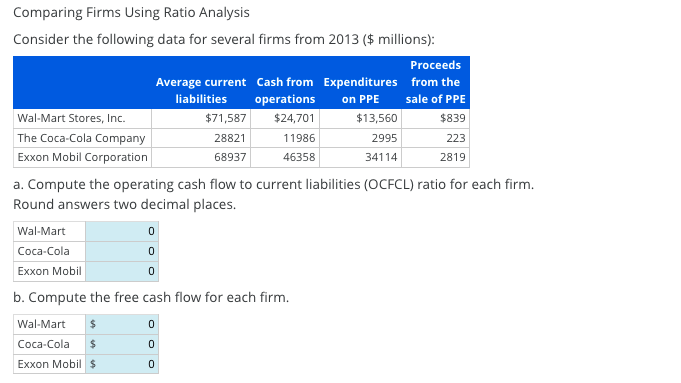

Comparing Firms Using Ratio Analysis Consider the following data for several firms from 2013 ($ millions): Proceeds Average current Cash from Expenditures from the liabilities operations on PPE sale of PPE Wal-Mart Stores, Inc. $71,587 $24,701 $13,560 $839 The Coca-Cola Company 28821 11986 2995 223 Exxon Mobil Corporation 68937 46358 34114 2819 a. Compute the operating cash flow to current liabilities (OCFCL) ratio for each firm. Round answers two decimal places. Wal-Mart Coca-Cola Exxon Mobil 0 b. Compute the free cash flow for each firm. Wal-Mart Coca-Cola 0 0 $ 0 $ 0 Exxon Mobil $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts