Question: Please answer with explanation for the last question. 2. A month after you were born, your grandparents have been depositing $100 into a savings account

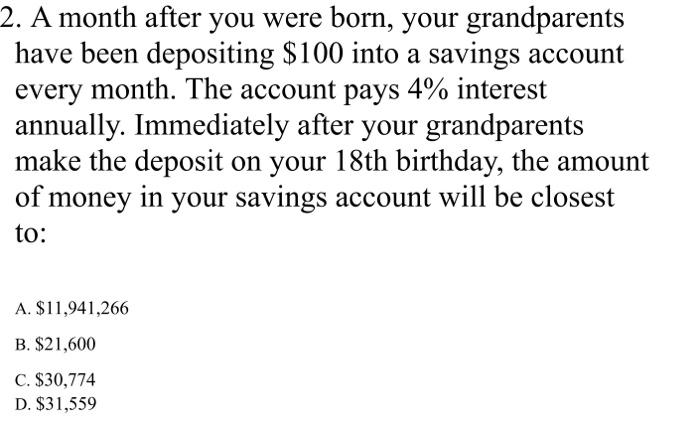

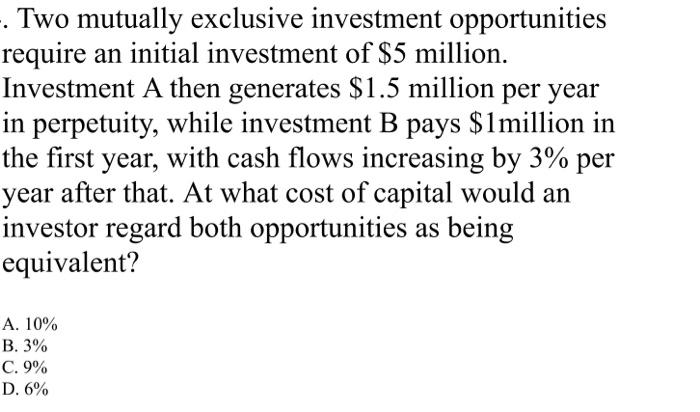

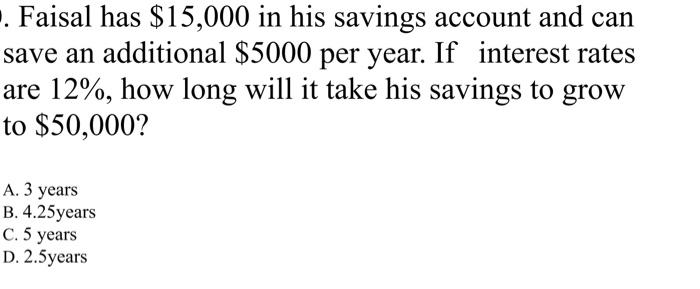

2. A month after you were born, your grandparents have been depositing $100 into a savings account every month. The account pays 4% interest annually. Immediately after your grandparents make the deposit on your 18th birthday, the amount of money in your savings account will be closest to: A. $11,941,266 B. $21,600 C. $30,774 D. $31,559 . Two mutually exclusive investment opportunities require an initial investment of $5 million. Investment A then generates $1.5 million per year in perpetuity, while investment B pays $1million in the first year, with cash flows increasing by 3% per year after that. At what cost of capital would an investor regard both opportunities as being equivalent? A. 10% B. 3% C. 9% D. 6% - Faisal has $15,000 in his savings account and can save an additional $5000 per year. If interest rates are 12%, how long will it take his savings to grow to $50,000? A. 3 years B. 4.25years C. 5 years D. 2.5years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts