Question: Please answer with formulas/ how you got answer. As well as help with filling out income statement at the bottom please 4) (6 points) Company

Please answer with formulas/ how you got answer. As well as help with filling out income statement at the bottom please

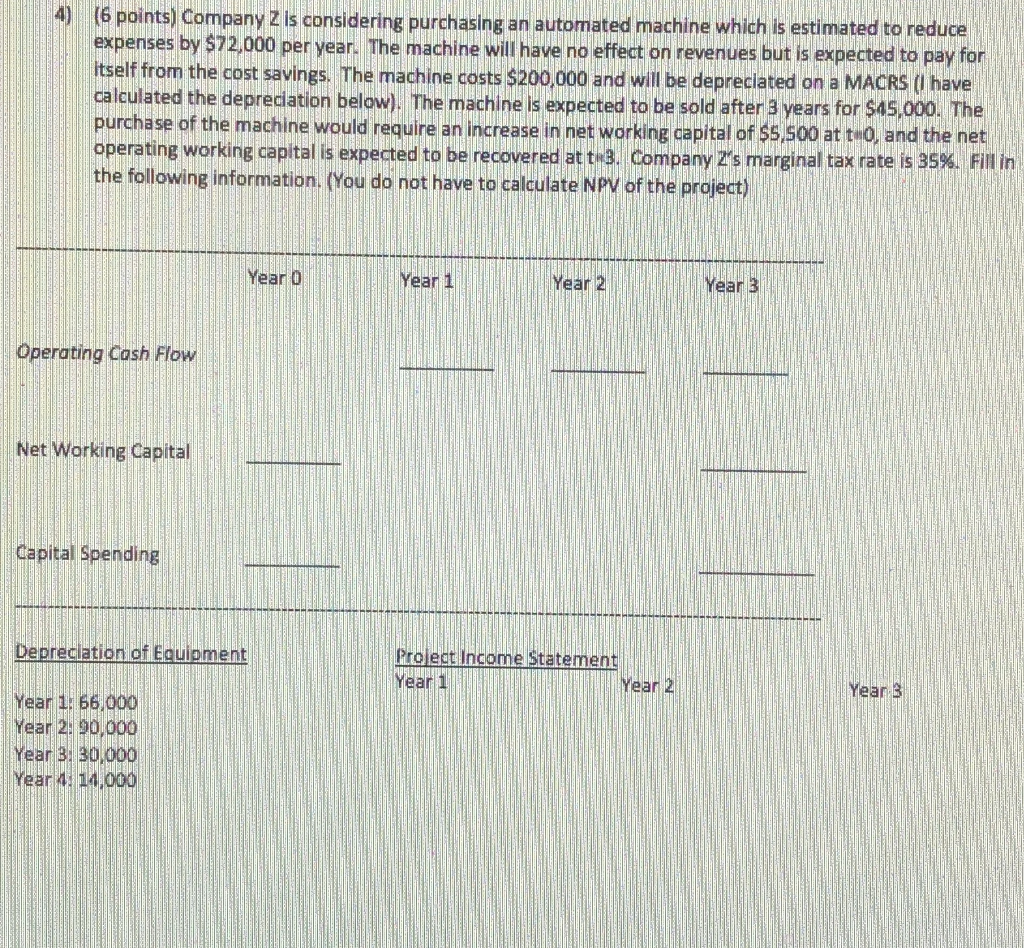

4) (6 points) Company 2 is considering purchasing an automated machine which is estimated to reduce expenses by $72,000 per year. The machine will have no effect on revenues but is expected to pay for Itself from the cost savings. The machine costs $200,000 and will be depreciated on a MACRS (I have calculated the depreciation below). The machine is expected to be sold after 3 years for $45,000. The purchase of the machine would require an increase in net working capital of $5,500 at to, and the net operating working capital is expected to be recovered at t 3. Company 2's marginal tax rate is 35%. Fill in the following information. (You do not have to calculate NPV of the project) Year o Year 1 Year 2 Year 3 Operating Cash Flow Net Working Capital Capital Spending Depreciation of Equipment Project Income Statement Year 1 Year 2 Year 3 Year 1: 56,000 Year 20 90 000 Year 3. 30,000 Year. 14.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts