Question: please answer with formulas in both questions in attachments Cintas Corporation designs, manufactures, and implements corporate identity uniform programs that it rents or sells to

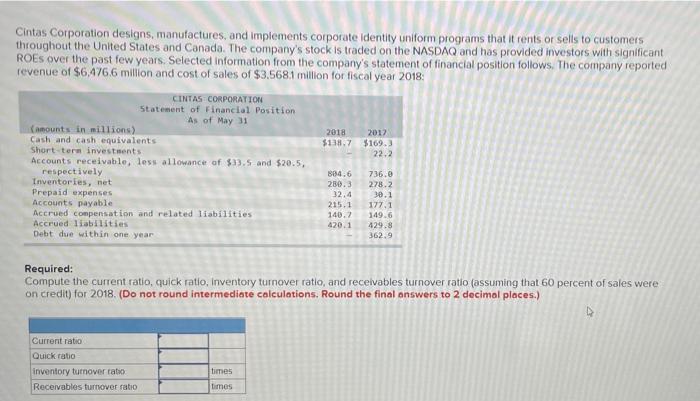

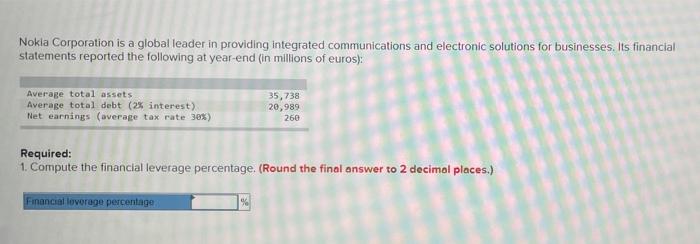

Cintas Corporation designs, manufactures, and implements corporate identity uniform programs that it rents or sells to customers throughout the United States and Canada. The company's stock is traded on the NASDAQ and has provided investors with significant ROES over the past few years. Selected information from the company's statement of financial position follows. The company reported revenue of $6,476.6 million and cost of sales of $3.568.1 million for fiscal year 2018: CINTAS CORPORATION Statement of Financial Position As of May 31 (amounts in millions) 2018 Cash and cash equivalents $138.7 2017 $169.3 22.2 Short-term investments i Accounts receivable, less allowance of $33.5 and $20.5, respectively 884.6 736.0 Inventories, net 280.3 278.2 Prepaid expenses 32.4 30.1 Accounts payable 215.1 177.1 Accrued compensation and related liabilities 140.7 149.6 Accrued liabilities 420.1 429.8 Debt due within one year 362.9 Required: Compute the current ratio, quick ratio, inventory turnover ratio, and receivables turnover ratio (assuming that 60 percent of sales were on credit) for 2018. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) 4 Current ratio Quick ratio inventory turnover ratio times Receivables turnover ratio times Nokia Corporation is a global leader in providing integrated communications and electronic solutions for businesses. Its financial statements reported the following at year-end (in millions of euros): Average total assets. Average total debt (2% interest). 35,738 20,989 260 Net earnings (average tax rate 30%) Required: 1. Compute the financial leverage percentage. (Round the final answer to 2 decimal places.) Financial leverage percentage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts