Question: Please answer with formulas in excel ASAP After seeing Snapple s success with noncola soft drinks and learning of Coke s and Pepsi s interest,

Please answer with formulas in excel ASAP

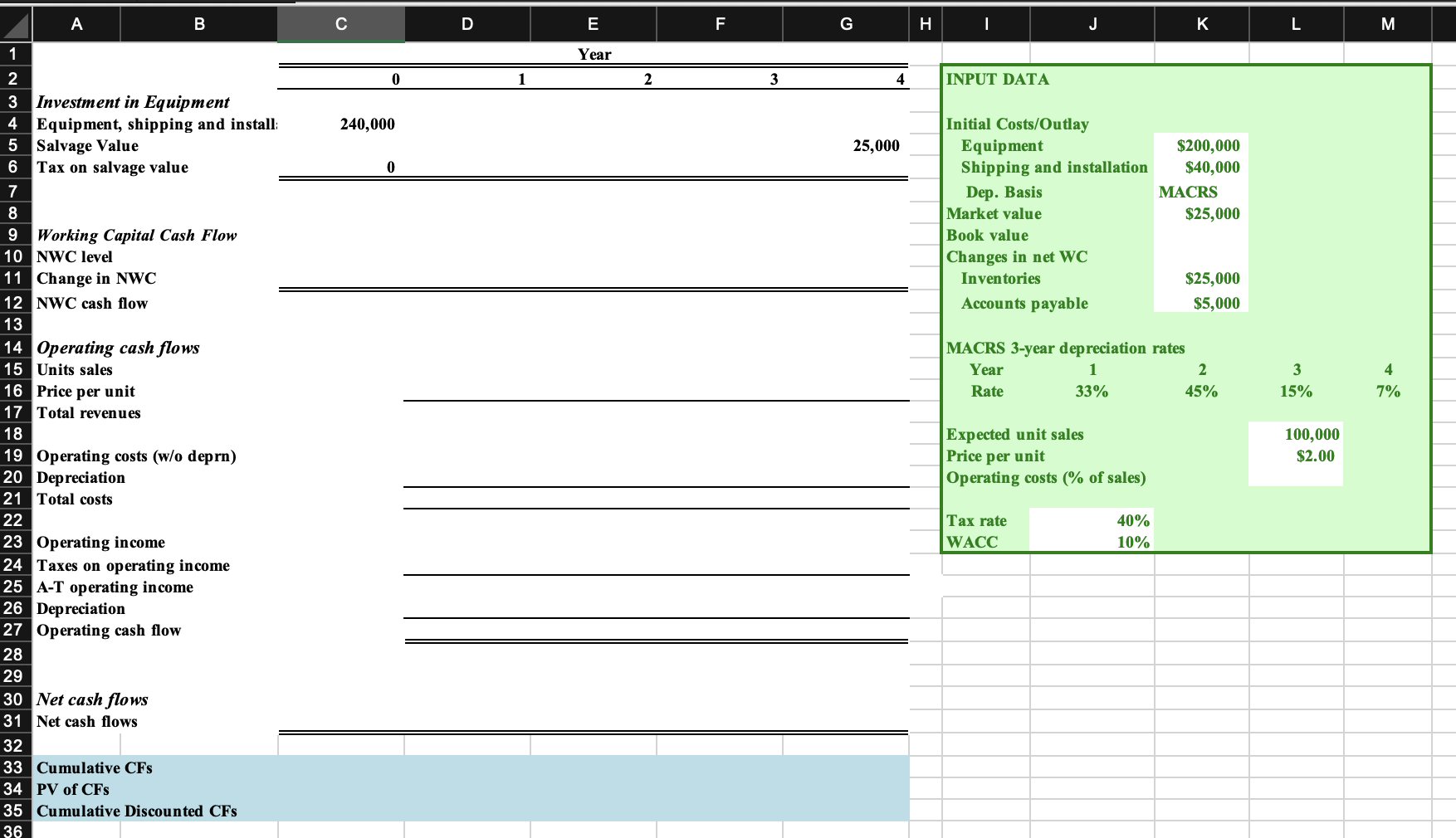

After seeing Snapples success with noncola soft drinks and learning of Cokes and Pepsis interest, allied food products has decided to consider an expansion of its own in the fruit juice business. The product being considered is fresh lemon juice. Assume that you were recently hired as assistant to the director of capital budgeting, and you must evaluate the new project. Breakeven Analysis

Q: What is the NPV breakeven level of units sales per year?

The lemon juice would be produced in an unused building adjacent to Allieds Fort Myers Plant; Allied owns the building, which is fully depreciated. The required equipment would cost $ plus an additional $ for shipping and installation. In addition, inventories would rise by $ while accounts payable would go up by $ All of these costs would be incurred at t By a special ruling, the machinery could be depreciated to a book value of zero under the MACRS system as year property. The applicable depreciation rates are percent, percent, percent, and percent. The taxes can be calculated as tax credit ie negative taxes if the taxable income is negative.

The project is expected to operate for years, at which time it will be terminated. The cash inflows are assumed to begin year after the project is undertaken, or at t and to continue out to t At the end of the projects life t the equipment is expected to have a market value of $

Unit sales are expected to total cans per year, and the expected sales price is $ per can. Cash operating costs for the project total operating costs less depreciation are expected to total percent of dollar sales. Allieds tax rate is percent, and its weighted average cost of capital is percent. Tentatively, the lemon juice project is assumed to be of equal risk to Allieds other assets.

You have been asked to evaluate the project and to make a recommendation as to whether it should be accepted or rejected. To guide you in your analysis, your boss gave you the following set of questions.

Calculate payback, discounted payback, IRR, MIRR, NPV and PI for this project.

What would be the NPV of the project if the operating costs are of sales? How about at the same time, unit sales is Finish the Sensitivity table in the Excel file.

What is the NPV breakeven level of unit sales each year?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock