Question: please answer with formulas of eaxh cell Forcefully Delicious Cookies has decided to offer Mom's SUPER special Cookies. I had market research done that cost

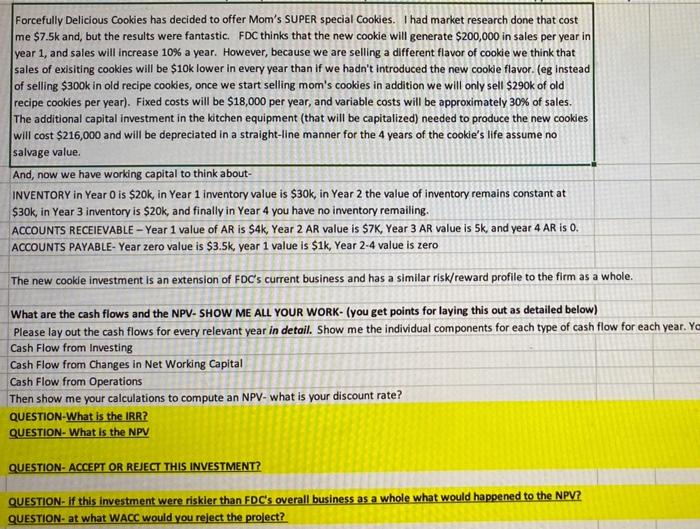

Forcefully Delicious Cookies has decided to offer Mom's SUPER special Cookies. I had market research done that cost me $7.5k and, but the results were fantastic. FDC thinks that the new cookie will generate $200,000 in sales per year in year 1, and sales will increase 10% a year. However, because we are selling a different flavor of cookie we think that sales of existing cookies will be $10k lower in every year than if we hadn't introduced the new cookie flavor. (eg instead of selling $300k in old recipe cookies, once we start selling mom's cookies in addition we will only sell $290k of old recipe cookies per year). Fixed costs will be $18,000 per year, and variable costs will be approximately 30% of sales. The additional capital investment in the kitchen equipment (that will be capitalized) needed to produce the new cookies will cost $216,000 and will be depreciated in a straight-line manner for the 4 years of the cookie's life assume no salvage value And, now we have working capital to think about INVENTORY in Year O is $20k, in Year 1 inventory value is $30k, in Year 2 the value of inventory remains constant at $30k, in Year 3 inventory is $20k, and finally in Year 4 you have no inventory remailing. ACCOUNTS RECEIEVABLE -Year 1 value of AR is $4k, Year 2 AR value is $7K, Year 3 AR value is 5k, and year 4 AR is O. ACCOUNTS PAYABLE-Year zero value is $3.5k, year 1 value is $1k, Year 2-4 value is zero The new cookle investment is an extension of FDC's current business and has a similar risk/reward profile to the firm as a whole. What are the cash flows and the NPV- SHOW ME ALL YOUR WORK- (you get points for laying this out as detailed below) Please lay out the cash flows for every relevant year in detail. Show me the individual components for each type of cash flow for each year. Yo Cash Flow from Investing Cash Flow from Changes in Net Working Capital Cash Flow from Operations Then show me your calculations to compute an NPV- what is your discount rate? QUESTION-What is the IRR? QUESTION- What is the NPV QUESTION- ACCEPT OR REJECT THIS INVESTMENT? QUESTION. If this investment were riskier than FDC's overall business as a whole what would happened to the NPV? QUESTION. at what WACC would you reject the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts