Question: Please answer with full working no copy paste Saltz Co. purchased 420 shares of Tolek Co's stock for $62 per share on December 12, 2012.

Please answer with full working no copy paste

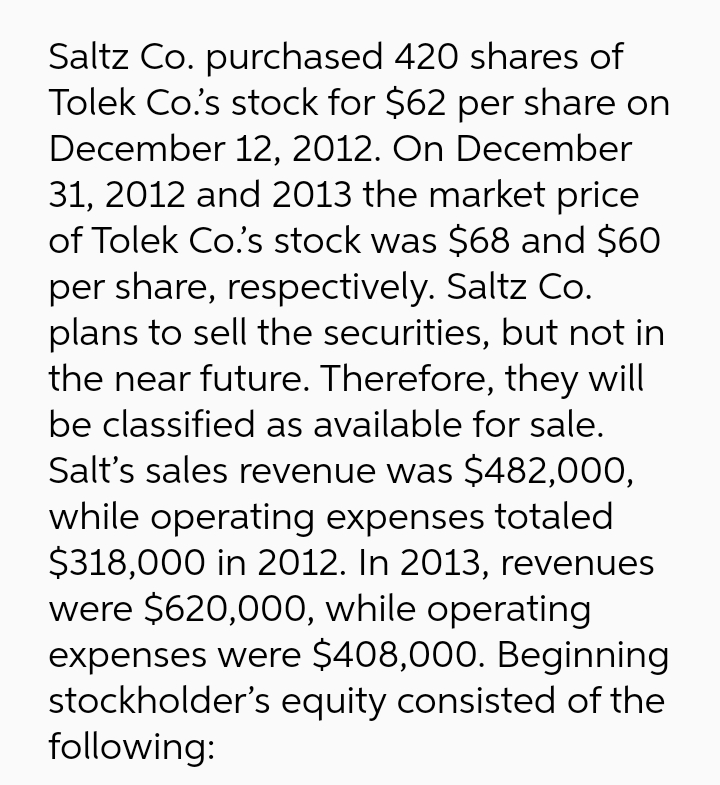

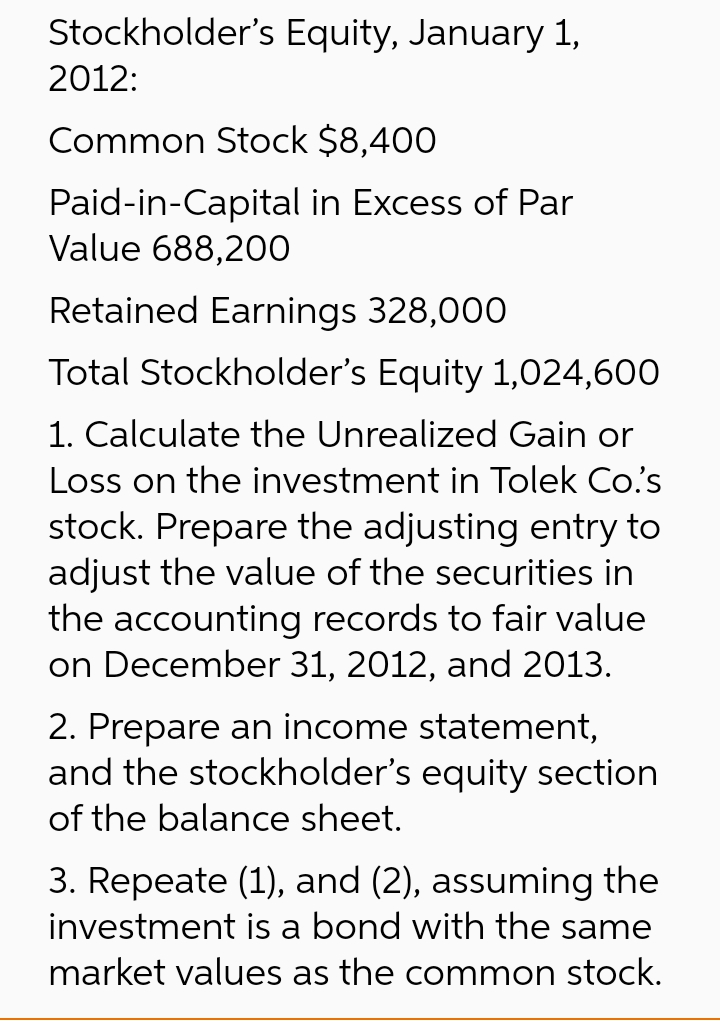

Saltz Co. purchased 420 shares of Tolek Co's stock for $62 per share on December 12, 2012. On December 31, 2012 and 2013 the market price of Tolek Co's stock was $68 and $60 per share, respectively. Saltz Co. plans to sell the securities, but not in the near future. Therefore, they will be classified as available for sale. Salt's sales revenue was $482,000, while operating expenses totaled $318,000 in 2012. In 2013, revenues were $620,000, while operating expenses were $408,000. Beginning stockholder's equity consisted of the following: Stockholder's Equity, January 1, 2012: Common Stock $8,400 Paid-in-Capital in Excess of Par Value 688,200 Retained Earnings 328,000 Total Stockholder's Equity 1,024,600 1. Calculate the Unrealized Gain or Loss on the investment in Tolek Co.'s stock. Prepare the adjusting entry to adjust the value of the securities in the accounting records to fair value on December 31, 2012, and 2013. 2. Prepare an income statement, and the stockholder's equity section of the balance sheet. 3. Repeate (1), and (2), assuming the investment is a bond with the same market values as the common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts