Question: Please answer with graphs included. Forecasting Box Office Returns For years, people in the motion picture industry critics, film historians, and others have eagerly awaited

Please answer with graphs included.

Forecasting Box Office Returns

For years, people in the motion picture industry critics, film historians, and others have eagerly awaited the second issue in January of Variety. Long considered the show business bible, Variety is a weekly trade newspaper that reports on all aspects of the entertainment industry; movies, television, recordings, concert tours, and so on. The second issue in January, called the Anniversary Edition, summarizes how the entertainment industry fared in the previous year, both artistically and commercially.

In this issue, Variety publishes its list of All Time Film Rental Champs. This list indicates, in descending order, motion pictures and the amount of money they returned to the studio. Because a movie theater rents a film from a studio for a limited time, the money paid for admission by ticket buyers is split between the studio and theater owner. For example, if a ticket buyer pays $12 to see a particular movie, the theater owner keeps about $6 and the studio receives the other $6. The longer a movie plays in a theater, the greater the percentage of the admission price returned to the studio. A film playing for an entire summer could eventually return as much as 90% of the $12 to the studio. The theater owner also benefits from such a success because although the owners percentage of the admission price is small, the sales of concessions (candy, soda and so on) provide greater profits. Thus, both the studio and the theater owner win when a film continues to draw audiences for a long time. Variety lists the rental figures (the actual dollar amounts returned to the studios) that the films have accrued in their domestic releases (United States and Canada).

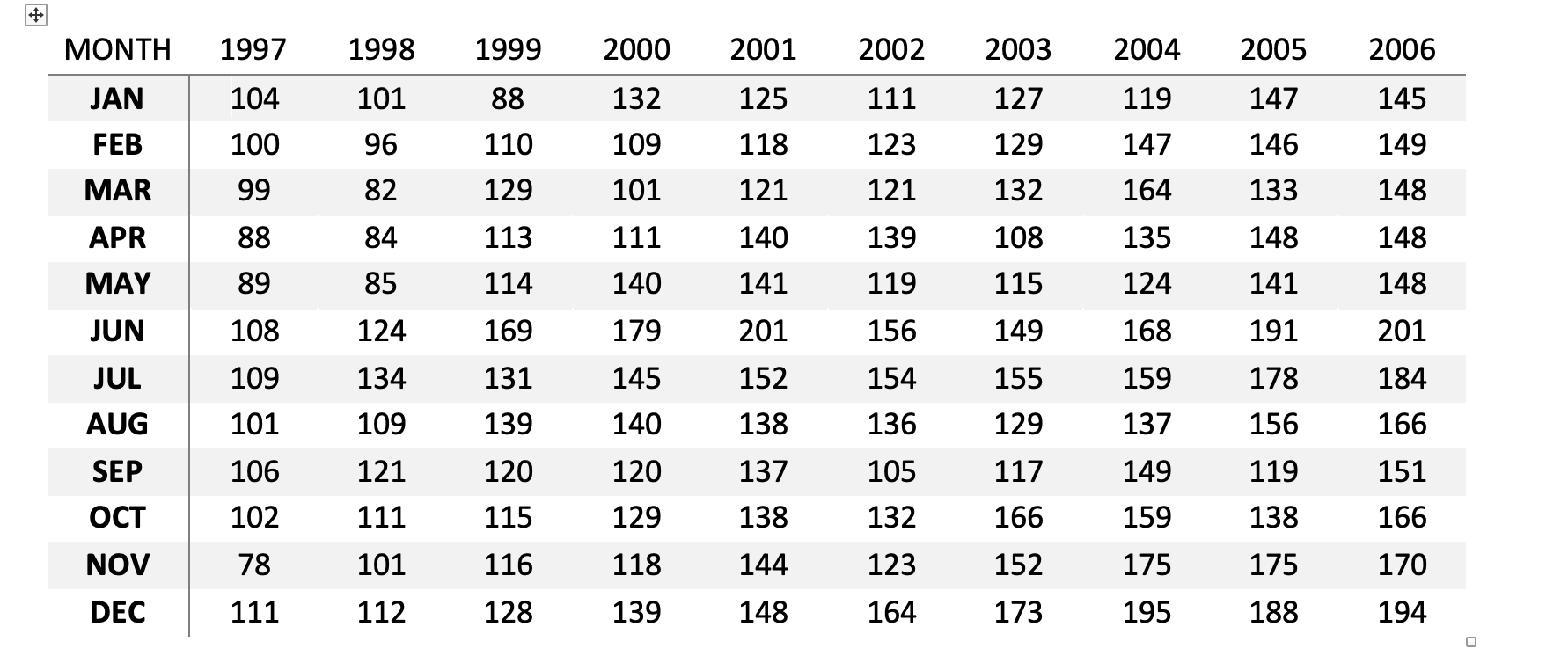

In addition, Variety provides a monthly Box-Office Barometer of the film industry, which is a profile of the months domestic box-office returns. This profile is not measured in dollars, but scaled according to some standard. By the late 1980s, for example, the scale was based on numbers around 100, with 100 representing the average box-office return of 1990. The figures from 1997 to 2006 are given in the table below and in the file BoxOffice.xlsx in blackboard.

All the figures are scaled around the 1990s box-office returns, but instead of dollars, artificial numbers are used. Film executives can get a relative indication of the box-office figures compared to the arbitrary 1990 scale. For example, in January 1997 the box-office returns to the film industry were 95% of the average that year, whereas in January 1998 the returns were 104% of the average of 1990 (or, they were 4% above the average of 1990s figure).

From the time series given in the above table, you will make a forecast for the 12 months of the next year, 2007.

- Produce a time series plot of the data. From this graph, do you see a pattern? Can you see any seasonality in the data?

- Use exponential smoothing to fit the data. Select an appropriate constant a based on the variation you see in the data. Comment on the appropriateness of exponential smoothing on this data set. Plot the predictions from this model on the graph with the original data. How well does this technique fit the data? Make forecasts for each month in 2007.

- Use regression to build a linear trend model. Comment on the goodness-of-fit of this model to the data (or, how well does R2 explain the variance in the data?). Plot the predictions from this model on the graph with the original data.

- Develop multiplicative seasonal indices for the linear trend model developed in question 3. Use these indices to adjust predictions from the linear trend model from question 3 above for seasonal effects. Plot the predictions from this model on the graph with the original data. How well does this technique fit the data? Make forecasts for the next 12 months of 2007 using this technique.

- Which forecasting method of those that you tried do you have the most confidence for making accurate forecasts for 2007? Use MAPE (mean absolute percent error) as your criterion to justify your decision.

Enrichment (5 pts): Use Optimization (and Solver in Excel) to find the optimal smoothing constant in problem 2 above (by minimizing the Mean Squared Error or MSE).

MONTH 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 88 125 111 147 104 100 101 96 132 109 127 129 119 147 145 149 110 118 123 146 JAN FEB MAR APR MAY 99 82 129 101 121 121 132 164 133 148 113 111 140 139 108 135 148 148 88 89 84 85 114 140 141 119 115 124 141 148 JUN 108 124 169 179 201 156 149 168 191 201 JUL 109 134 131 145 154 155 159 178 184 152 138 AUG 101 109 139 140 136 129 137 156 166 SEP 106 121 120 120 137 105 117 149 119 151 OCT 111 115 129 138 132 166 159 138 166 102 78 NOV 101 116 118 144 123 152 175 175 170 DEC 111 112 128 139 148 164 173 195 188 194 O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts